2024 in Review: A Year of Transformation and High-Conviction Investing

Reflecting on portfolio restructuring, performance, launching a newsletter, and future goals

2024 was a pivotal year for my investing journey. It marked a deliberate shift in strategy, from holding a mutual fund1 and investment trusts2 as the bulk of my portfolio to focusing exclusively on individual companies. This change was about taking greater ownership of my decisions, refining my process, and aligning my portfolio with businesses I understand and believe in.

It was also the year I launched Level-Headed Investing, a newsletter dedicated to sharing insights, and reflections. Writing about investing has proven to be just as rewarding as managing my portfolio, offering a platform to crystallize my thoughts and hopefully help others in their investing journey.

Selling Fundsmith: From Diversification to Focus

One of the defining moves of 2024 was selling my position in Fundsmith equity mutual fund in June, locking in a ~21% profit after holding it for over three years. While Fundsmith had delivered solid returns to its investors over the years, my conviction in its top holdings waned, and I began questioning whether the fund’s strategy still aligned with my goals.

Portfolio Decisions I Disagreed With

Before diving into specific disagreements, I want to acknowledge that Terry Smith is a charismatic and renowned portfolio manager whose disciplined approach to investing has earned him widespread respect. His focus on high-quality businesses with strong returns on capital and sustainable competitive advantages has made Fundsmith one of the most successful and well-regarded funds globally.

I have learned a great deal from Smith’s philosophy, particularly his emphasis on buying good companies, not overpaying, and doing nothing, a mantra that resonates deeply with me.

His insights into intangible assets and their ability to drive long-term value in the digital era better than tangible ones have shaped my thinking over the years. For those interested, here is a recent interview that captures the essence of his investment philosophy:

Despite parting ways with Fundsmith, I hold Terry Smith in high regard. His interviews and shareholder letters remain valuable resources, especially for newer investors.

That said, even great investors make mistakes. The fund’s portfolio had, in my view, drifted from the principles I prioritize, growth at reasonable valuations, and avoiding areas outside my circle of competence (e.g., pharma):

Selling Amazon (AMZN 0.00%↑) at a favorable dip, only to miss its subsequent rally, despite Amazon still looking attractively priced on operating cash flow metrics. He admitted this mistake in multiple interviews.

Holding onto Estée Lauder (EL 0.00%↑) , despite evident mismanagement and severe supply chain issues in Asia.

Exiting Intuit (INTU 0.00%↑) too soon, missing out on gains.

Stay invested in PayPal (PYPL 0.00%↑) even as the company struggled with years of poor performance, losing market share and failing to reignite growth.

While I greatly admire Smith’s long-term vision and analytical rigor, these moves highlighted differences in our investment approaches and reinforced my desire to take full ownership of my portfolio by focusing on individual holdings.

Concerns About Top Holdings

Across the Fundsmith portfolio, many holdings appeared either overvalued (e.g. Novo Nordisk and Microsoft) or stagnating (e.g. LVMH). While these companies are market leaders, I saw limited upside relative to their prices. This was the composition of the mutual fund at the time I exited in early June 2024:

Novo Nordisk (NVO 0.00%↑): At 14% of the portfolio, this pharma giant dominated Fundsmith’s allocations. Yet, it operates in a sector I intentionally avoid, one requiring deep industry expertise to assess long-term risks like patent expiration and regulatory hurdles. Its Price-to-Free-Cash-Flow (P/FCF) of 51.63x made it hard for me to justify holding it.

LVMH (MC.PA): While a high-quality luxury conglomerate with a wide moat, its growth has slowed in the past three years, resulting in free cash flow plummeting -7.4% annually and a muted growth to operating cash flow of 2.2% CAGR as of H1 2024. My analysis suggested near-saturation outside Asia, limiting upside in the next years.

Microsoft (MSFT 0.00%↑): A leader in cloud computing, a strong AI player and innovator, with a pristine balance sheet, led by a visionary CEO, but its valuation seemed stretched, making it difficult to view as a compelling buy at those levels.

Reinvesting in High-Conviction Holdings

The proceeds from Fundsmith were redeployed into individual holdings where I have high conviction and which, based on my estimates of their intrinsic value, appeared undervalued. These include:

Alphabet (GOOGL 0.00%↑) – The undisputed leader in online search and digital advertising, with additional growth engines in cloud computing, video streaming (YouTube), and enterprise tools (Google Workspace). Despite regulatory challenges, Alphabet stands to benefit from advancements in AI and its integration across products, further reinforcing its competitive advantage.

Amazon (AMZN 0.00%↑) – The global leader in e-commerce and cloud computing, complemented by a rapidly growing digital advertising business. Positioned for long-term growth driven by AI-powered innovations across its core platforms, Amazon remains undervalued relative to its future earnings potential.

Brookfield Corporation (BN 0.00%↑) – A global leader in asset management, offering diversified revenue streams through alternative investments, wealth solutions, and operating businesses. With a proven track record of compounding returns and a focus on long-term value creation, Brookfield provides both resilience and growth potential.

MercadoLibre (MELI 0.00%↑) – The dominant e-commerce and a leading fintech platform in Latin America, leveraging its first-mover advantage to expand market share and enhance profitability. With a scalable ecosystem and growing adoption of digital payments, MercadoLibre is well-positioned for continued growth in the region.

This consolidation allowed me to double down on high-quality compounders that I believe are poised to outperform long-term rather than relying on a diversified fund to make those decisions for me. Since the sale, Fundsmith has returned 2.05%, while my holdings have returned in aggregate 16.92%. While this short-term performance proves little in isolation, it does reinforce my belief that some of Fundsmith’s core holdings were overvalued when I exited in June 2024.

Exiting SMT: Accepting Short-Term Underperformance

In November I sold my position in Scottish Mortgage Investment Trust (SMT) at a small gain, reallocating the capital into what I believed were undervalued individual companies.

SMT is managed by Tom Slater of Baillie Gifford, having been previously led by James Anderson, a visionary investor and patient capital allocator. Under their stewardship, SMT has followed a growth investing philosophy, focusing on innovative, disruptive companies with high growth potential over the long term. Its strategy has been centered on identifying transformational businesses early and holding them through volatility, a hallmark of patient capital allocation.

While I admire SMT’s research, and its history of delivering impressive long-term returns, I decided to sell because I wanted direct control over my portfolio and to focus on businesses I could analyze deeply and track closely.

Unlike my Fundsmith exit, this decision hasn’t yet paid off financially: SMT has returned 9.34% since I sold, while the companies I reinvested in have underperformed in the short term. However, I remain confident in the underlying businesses I bought.

Reflecting on My 2024 Performance

While the shift from funds and investment trusts to concentrated portfolio made up of individual holdings required more research and a willingness to accept and take advantage of heightened short-term volatility, it was a move toward greater control, clarity, and alignment with my investing principles.

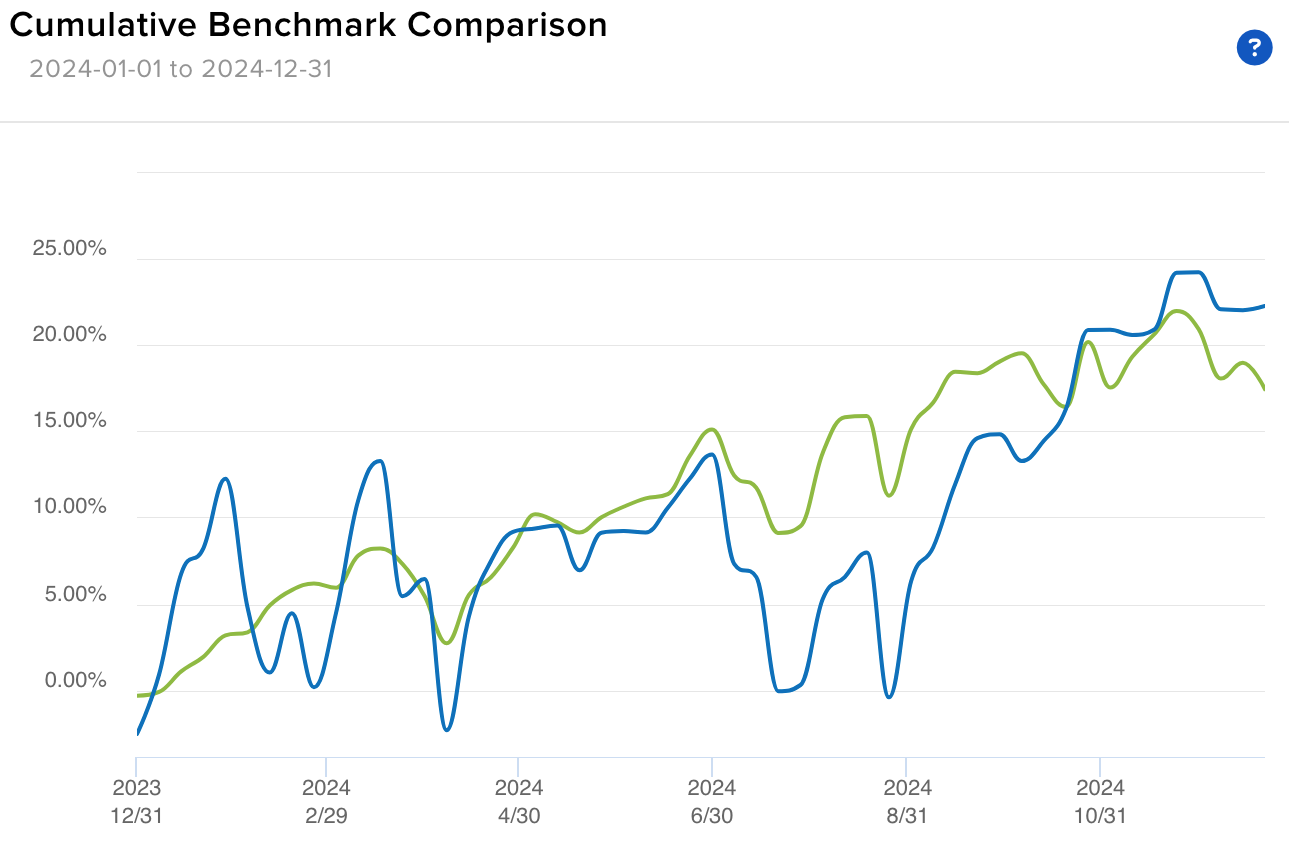

While adopting this focused and concentrated approach, I ended the year with a money-weighted return (MWR) of 22.29%, beating the 18.41% return of the iShares MSCI ACWI Index (USD) ETF that tracks the MSCI All Country World Index (ACWI)3, a commonly used benchmark for global equity performance across developed and emerging markets. This makes it a fair comparison, given my investments in developed markets such as the U.S. (AMZN 0.00%↑) and Canada (BN 0.00%↑) , as well as in emerging markets like China (PDD 0.00%↑) and Latin America (MELI 0.00%↑).

While it’s tempting to measure success solely against a benchmark, I see this result as validation that sticking to my principles - buying quality businesses at reasonable valuations and focusing on long-term compounding potential - can deliver competitive returns.

More importantly, it reinforces my belief that performance should be evaluated not by short-term market fluctuations, but by the strength of the businesses owned and their ability to generate sustainable growth over time. To build on this approach, I plan to review the yearly performance of my businesses as soon as year-end results are released in the next few weeks.

This evaluation will treat my portfolio as a company, accounting for the stakes I own in each business on a look-through basis, much like how a holding company reports the performance of its subsidiaries. I will analyze whether the underlying businesses have improved over the year and if my portfolio in aggregate has strengthened based on key metrics, including weighted ROIC (Return on Invested Capital) and weighted year-on-year top-line (revenue) and bottom-line (earnings) growth. I believe that this business-owner mindset helps ensure my focus remains on the fundamentals that drive long-term value creation rather than short-term price movements.

Launching Level-Headed Investing

A highlight of 2024 was launching the Level-Headed Investing platform in the summer. Writing regularly has forced me to articulate my thoughts clearly and document my evolving approach. It has also provided a space to share insights on company analysis, market dynamics, and my take on timeless investing principles.

My goal is to continue refining my approach and learning from both successes and setbacks. Future topics will include deep dives into specific companies, reflections on market cycles, book reviews and practical frameworks for analyzing investments. I view the newsletter as a natural extension of my investment process, encouraging deeper reflection, holding myself accountable for my decisions, and inviting feedback from readers, especially when it challenges my thinking.

Some Topics Covered In 2024

Alphabet and the AI revolution: My investment thesis for Alphabet (Google), assessing its strengths, challenges, and leadership in online search, digital advertising, artificial intelligence and cloud computing.

The role of technology in modern business: How technology blurs the line between traditional and tech companies, reshaping value investing strategies.

Investing in China: Examining China’s economic transformation, regulatory landscape, and opportunities for long-term investors.

Compounders: The Key to Long-Term Investment Success: A deep dive into identifying businesses with compounding potential and building wealth through patience and discipline.

Looking Ahead: Building on 2024’s Foundation

2024 was a year of transformation, stepping away from funds and trusts, embracing individual companies, and committing to a concentrated portfolio strategy. Notably, 50% of my portfolio is concentrated in my top three holdings, reflecting my conviction in the businesses I own. This approach aligns with the wisdom of the Oracle of Omaha, Warren Buffett, and his late business partner, Charlie Munger, who famously advocated for focus and high-conviction investing.

Looking ahead to 2025, my focus will remain on:

Reinforcing conviction: Doubling down on winners while cutting positions that disappoint in their fundamental performance over an extended period.

Continuous learning: Staying humble and adaptable, especially in the face of evolving markets. I plan to continue reading investing books, essays by legendary investors, annual shareholder letters, and financial reports of companies I own and those that are in my investable universe.

Writing and sharing: Expanding Level-Headed Investing as both a platform for sharing insights and a tool for maintaining my own accountability. In the coming months, I aim to write about my portfolio composition, the risk/reward balance of concentration, and share my thoughts around diversification within a concentrated portfolio. I also hope these reflections and insights will prove useful to others on their investing journey.

While no strategy is perfect, 2024 reinforced that intentional decisions, grounded in research, reflection, and conviction, can build both confidence and clarity in managing a portfolio. I’m excited to continue this journey, learning from past moves, adapting to new insights, and staying focused on long-term growth and value creation.

A mutual fund is a pooled investment vehicle that collects money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. It is professionally managed and allows investors to gain exposure to a broad range of assets without having to select individual investments themselves.

An investment trust is a publicly traded company that pools investor capital to invest in a diversified portfolio of assets, such as stocks, bonds, or illiquid assets. Unlike mutual funds, investment trusts are closed-ended, meaning they have a fixed number of shares traded on a stock exchange, and their price can differ from the underlying Net Asset Value (NAV).

The MSCI All Country World Index (ACWI) captures large and mid cap representation across Developed Markets (DM) and Emerging Markets (EM) countries. The index covers approximately 85% of the global investable equity opportunity set.