Alphabet Inc. (Google): A Comprehensive Analysis of Its Business and Investment Case

A deep dive into Alphabet's leadership, competitive advantages, financial strength, strategic growth plans and my investment thesis

“Google is not a conventional company. We do not intend to become one. Throughout Google’s evolution as a privately held company, we have managed Google differently. We have also emphasized an atmosphere of creativity and challenge, which has helped us provide unbiased, accurate and free access to information for those who rely on us around the world.”

— Larry Page and Sergey Brin, Google Founders’ IPO Letter

Google’s mission, as outlined by its founders Larry Page and Sergey Brin in their 2004 IPO letter, is to “organize the world’s information and make it universally accessible and useful”. From its inception, Google has stood apart as a company driven by innovation, creativity, and a commitment to its mission. This ethos has guided its approach to solving complex problems and delivering products that empower users globally. By fostering an environment that challenges conventional thinking and prioritizes unbiased access to information, Google has built a business that reflects its founders’ vision of leveraging technology to improve lives.

Alphabet Inc. (GOOGL 0.00%↑), the parent company of Google was established in 2015 following a corporate restructuring. It is a holding company that encompasses Google, its primary revenue driver, alongside a suite of ambitious Other Bets. Beneath the surface lies a remarkable business that has continually demonstrated resilience, adaptability, and immense growth potential. Despite challenges from competitors and regulatory pressures, Alphabet’s core business, competitive advantage, and strategic vision make it a compelling case for inclusion in a quality portfolio.

In this article, I lay the foundation for a multi-part series delving into Alphabet’s business, starting with an exploration of its leadership, moat, the business segments that drive its revenue and profit and its financial strength. I discuss its growth engines, including Google Search’s steady performance, the rapid rise of segments like YouTube Ads and Google Cloud, and the company’s ongoing innovation to stay ahead of emerging technologies like generative AI and autonomous vehicles. Future articles build on this analysis by addressing Alphabet’s challenges, from fierce competition to regulatory scrutiny, as well as examining its capital allocation strategy and valuation. You can read the second article of this series here:

Together, this series aims to provide a comprehensive view of Alphabet’s position in the market and its potential as a quality investment.

Challenges and Opportunities in Alphabet’s Future

While Alphabet’s dominance and innovation make it a compelling investment, it faces challenges that cannot be overlooked. Increasing regulatory scrutiny, including antitrust investigations and potential calls for breaking up its businesses, poses legal and operational risks. Additionally, the rise of AI-powered tools like OpenAI ChatGPT and Microsoft Copilot has intensified competition in search and productivity tools, directly challenging Alphabet’s core business.

However, AI is not just a competitive threat, it also represents one of Alphabet’s greatest opportunities. The company’s deep expertise in AI, showcased by its advancements in products like Google Gemini and AI integration across Search, Ads, and Cloud, positions it to lead the AI-driven future. Alphabet’s ongoing investments in AI research and infrastructure highlight its commitment to staying at the forefront of this transformative shift.

These challenges and opportunities underscore the importance of Alphabet’s resilience, adaptability, and long term strategic focus, which I explore in this series.

Google’s Early Days: From Startup to Scaleup

Google’s story begins in 1996, when two Stanford University Ph.D. students, Larry Page and Sergey Brin, set out to solve a complex problem: how to make sense of the rapidly expanding Internet. At the time, search engines like Yahoo, AltaVista, and Lycos relied on simple keyword matching to produce search results. Page and Brin, however, believed that a better approach was possible. They developed an algorithm called PageRank, which evaluated the importance of web pages based on the number and quality of links pointing to them. This innovation laid the groundwork for a search engine that could deliver more relevant and accurate results.

By 1998, the pair had formally launched Google Inc., operating out of a garage in Menlo Park, California. The company’s name, derived from the mathematical term googol, symbolized its mission to organize an almost infinite amount of information. In its early years, Google faced stiff competition from established players like Yahoo, which dominated the search market with its directory-based model and sprawling homepage filled with news, ads, and links.

Google’s success stemmed from its superior algorithm and a minimalist design that prioritized simplicity over cluttered portals like Yahoo. Its clean interface made search faster and more intuitive, attracting users who valued efficiency.

Google’s 2000 launch of AdWords revolutionized online advertising, aligning search intent with targeted ads. This pay-per-click model transformed Google into an advertising powerhouse.

Expanding its ecosystem, Google introduced Gmail (2004), Google Maps (2005), and acquired YouTube (2006), embedding itself into daily life. The release of Android (2008) further strengthened its dominance in mobile.

Alphabet’s Leadership and Mission-driven Culture

Google’s founders, Larry Page and Sergey Brin, instilled a mission-driven culture focused on using technology to “organize the world’s information and make it universally accessible and useful”. This ethos has been the cornerstone of Google’s operations since its inception, driving both relentless innovation and exceptional profitability. Their engineering-led management style prioritized product development over bureaucracy, ensuring a long term focus on R&D and disruptive advancements.

While Google’s substantial cash reserves may frustrate some investors seeking dividends, the founders’ emphasis on reinvestment reflected their commitment to optimizing innovation over short-term financial gains, a vision that continues to shape the company’s trajectory and one I strongly support.

“If opportunities arise that might cause us to sacrifice short term results but are in the best long term interest of our shareholders, we will take those opportunities. We will have the fortitude to do this.”

— Larry Page and Sergey Brin, Google Founders’ IPO Letter

Duing Eric Schmidt’s tenure as CEO (2001–2011), Google experienced transformative growth, scaling from a niche search engine to a global technology leader. Schmidt provided the operational expertise and management discipline needed to complement the founders’ visionary approach, steering the company through its IPO in 2004 and laying the groundwork for its dominance in digital advertising. His leadership helped institutionalize a culture of innovation while maintaining focus on execution, enabling Google to scale its infrastructure, expand globally, and diversify into new businesses.

Since Sundar Pichai took over as CEO in 2015, and of the holding company Alphabet in 2019, the company has continued to evolve. Pichai has further solidified Google’s position as a leader in artificial intelligence and cloud computing while navigating complex regulatory challenges and intensifying competition. His pragmatic leadership style has emphasized balancing growth and operational efficiency, as evidenced by recent cost-cutting measures and a renewed focus on profitability in segments like Google Cloud. Under Pichai’s stewardship, Alphabet remains steadfast in its mission-driven approach while adapting to the demands of a rapidly changing digital economy, ensuring its long term resilience and growth.

Having established Alphabet’s leadership and mission-driven culture, it’s important to examine the structural advantages that underpin its dominance across industries and fuel its long term growth.

Alphabet’s Competitive Advantages

Alphabet possesses one of the widest competitive advantages I have ever seen, underpinned by network effects, brand strength, economies of scale, and diversified growth engines.

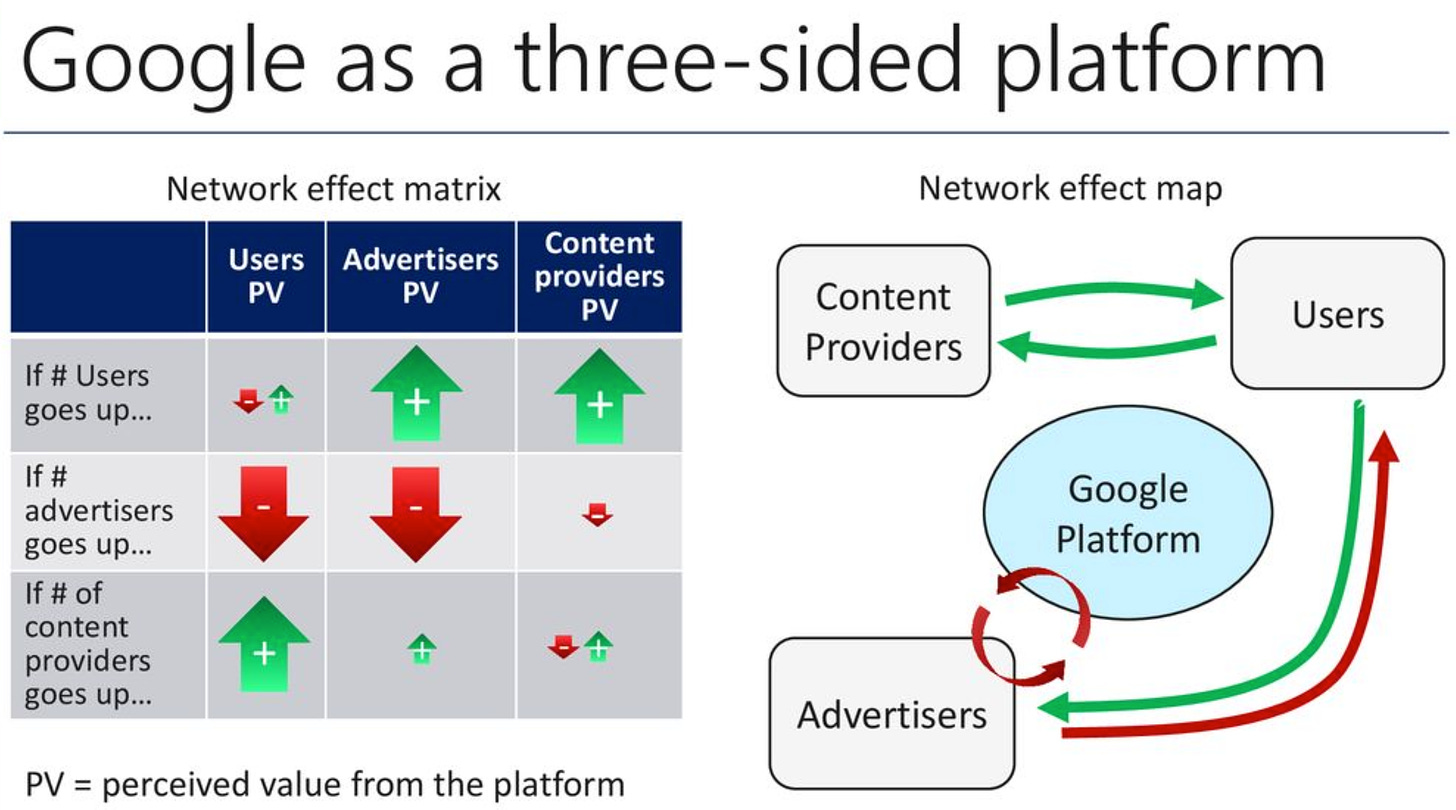

Network effects: This advantage lies at the hearth of Google Search’s dominance. Unlike traditional network effects, which rely solely on users attracting more users and advertisers, Alphabet’s ecosystem integrates users, advertisers, and creators into a self-reinforcing virtuous cycle.

Users feed data into Google’s algorithms, improving search accuracy and attracting even more users.

Content creators optimize their platforms to appear in search results.

Business creators use Google to connect with customers, further enriching the ecosystem through tools like AdSense.

What sets Google apart is its ability to identify trends and gaps in user behavior and develop new products in response: Rising demand for navigation led to Google Maps, and dissatisfaction with web browsers resulted in Chrome, both becoming market leaders.

This data-driven innovation loop continually expands Google’s ecosystem, making it more indispensable while fueling growth. This loop extends to other platforms like YouTube, which benefits from the largest audience and richest content catalog.

Brand strength: Google is synonymous with Internet search, with its name becoming a verb (“to google”) globally.

Economies of scale: Massive infrastructure investments allow Alphabet to deliver lightning-fast search results, provide robust cloud services, and develop cutting-edge AI capabilities, advantages smaller competitors struggle to match.

Diversified growth engines: Ecosystem synergies through Android, YouTube, Chrome, and partnerships with advertisers amplify its reach and effectiveness. While Google Search and YouTube drive the lion’s share of Alphabet’s revenue, the company’s growth trajectory is increasingly supported by other engines: Google Cloud segment is now profitable and rapidly scaling. With enterprise adoption of AI and cloud solutions accelerating, Google Cloud is poised to become a significant driver of Alphabet’s long term profit growth.

The Winner-Takes-All Effect

Alphabet’s competitive moat is also strengthened by winner-takes-all dynamics common in digital markets. Unlike traditional industries, where competitors can coexist, digital platforms favor market leaders due to learning curves and habit formation. Google Search exemplifies this dynamic. Using Google may feel instinctive, but users gradually learn to interact with its algorithm to improve search results, creating a reinforcing habit loop: the more they search, the better their experience becomes, making it harder to switch to alternatives.

For competitors to displace Google, they must either deliver superior relevance and ease of use or address unmet needs so effectively that users are willing to relearn behaviors. So far, no rival has come close. Google has continuously scaled its data advantages, strengthened its network effects, and maintained habit-driven loyalty, solidifying its dominance in a market defined by familiarity, efficiency, and lock-in effects.

In the next article of this multi-part series, I assess Alphabet’s economic moat’s resilience in the face of regulatory pressures and rising competition.

Building on Alphabet’s competitive advantages, let’s take a closer look at its diverse business segments and explore how each contributes to its revenue growth and strategic expansion.

Alphabet’s Business Segments and Growth Engines

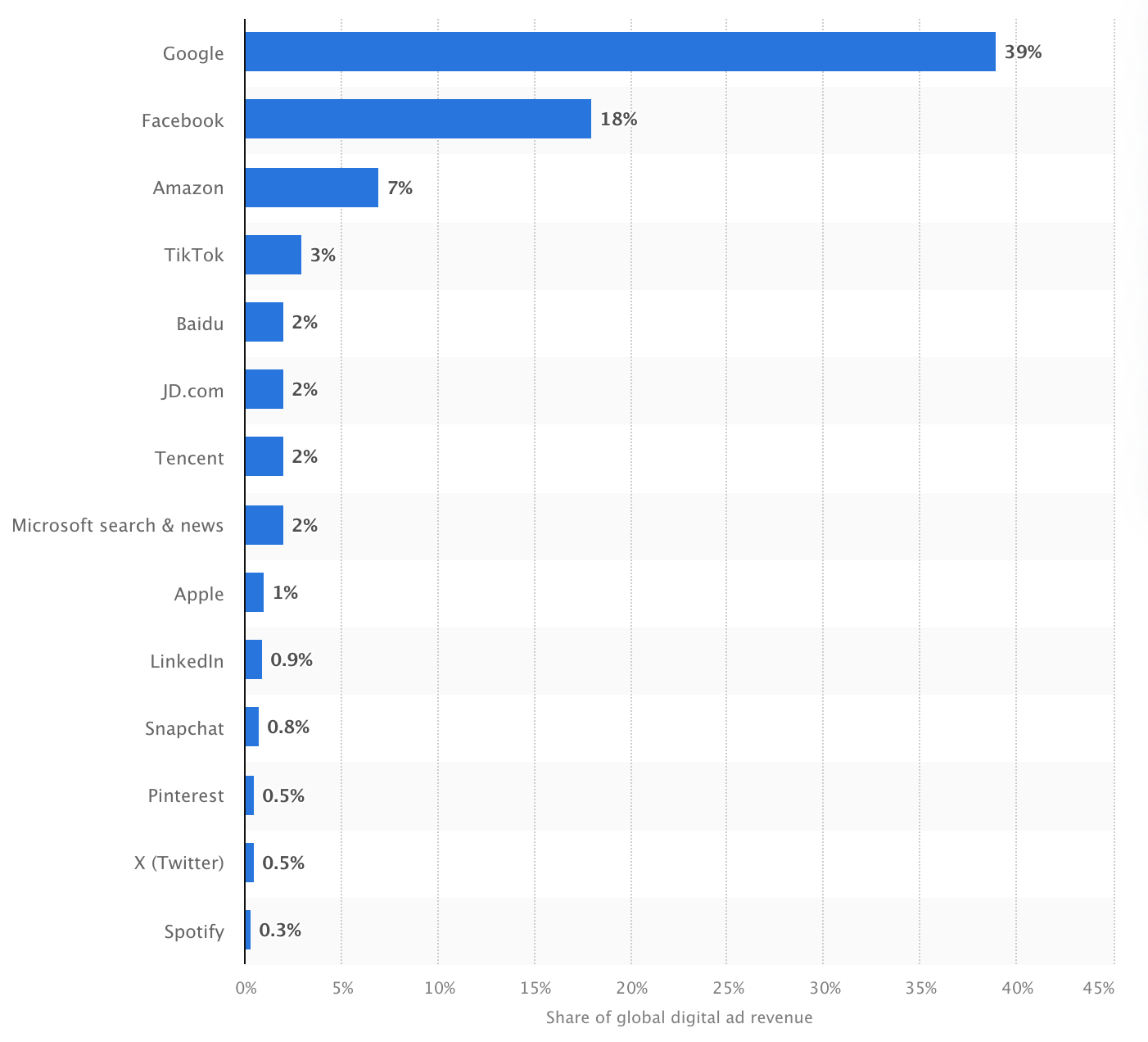

The core search and advertising business of Google operates independently from other experimental and innovative ventures of the parent company Alphabet. Google remains the crown jewel, contributing over 99% of Alphabet’s revenue and all of its profit. Its dominance in global digital advertising, commanding 39% of the market, is underpinned by unmatched algorithms, extensive data resources, and unparalleled brand equity.

Google Search: Unrivaled Dominance

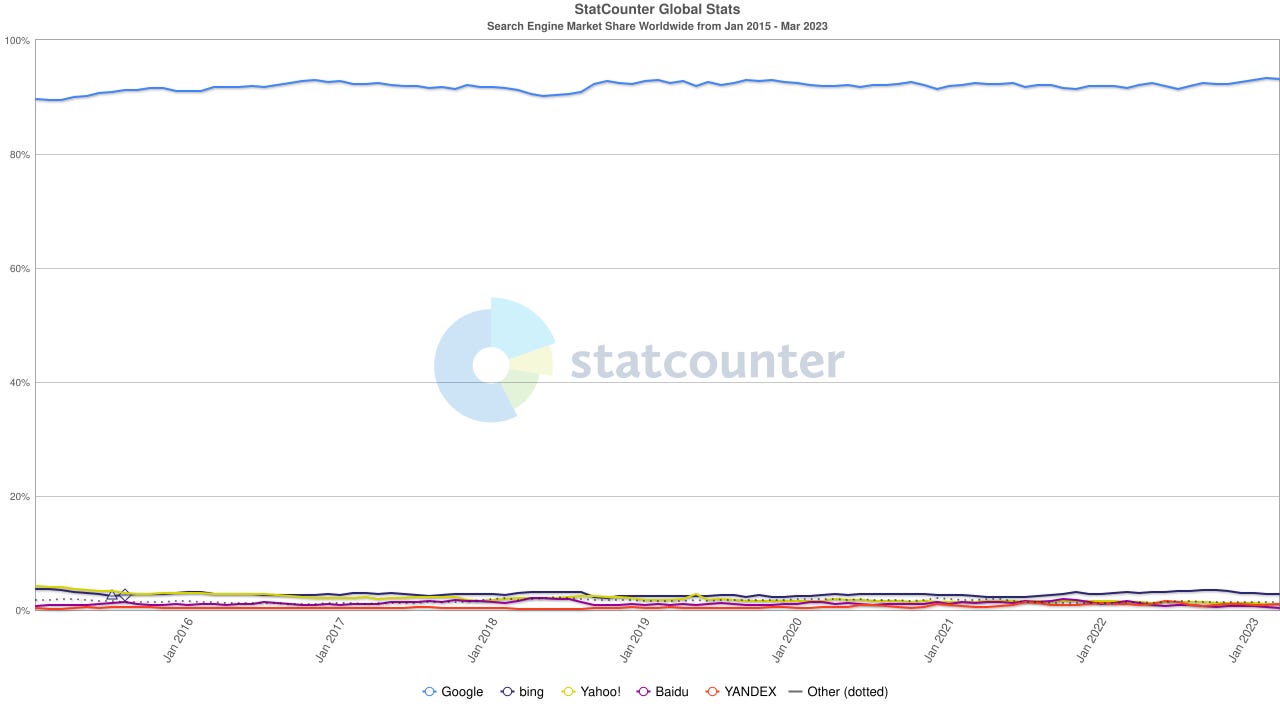

Google’s share of the online searches has consistently ranged between 86% and 93% over the past decade, underscoring its unassailable dominance in this sector.

This commanding lead is fueled by its superior search algorithms, which deliver the most relevant and precise results, and its ability to leverage vast amounts of data to continuously refine the user experience. Competitors like Microsoft’s Bing and Yahoo! Search have struggled to narrow the gap, as Google’s entrenched position is fortified by its network effects.

Google’s brand strength also plays a critical role: It has become synonymous with search itself, to the point where googling is now a universal term for finding information online. Partnerships with major device manufacturers, including Apple and Android vendors, further strengthen Google’s position as the default search engine on billions of devices worldwide. This reach amplifies its engagement and monetization opportunities, ensuring its central role in the expanding digital advertising landscape.

This dominance in the online search market translates directly into ads revenue, with Google Search & Other segment of revenue being the company’s largest revenue driver: In 2023, this segment accounted for 56.9% of Alphabet’s total revenue.

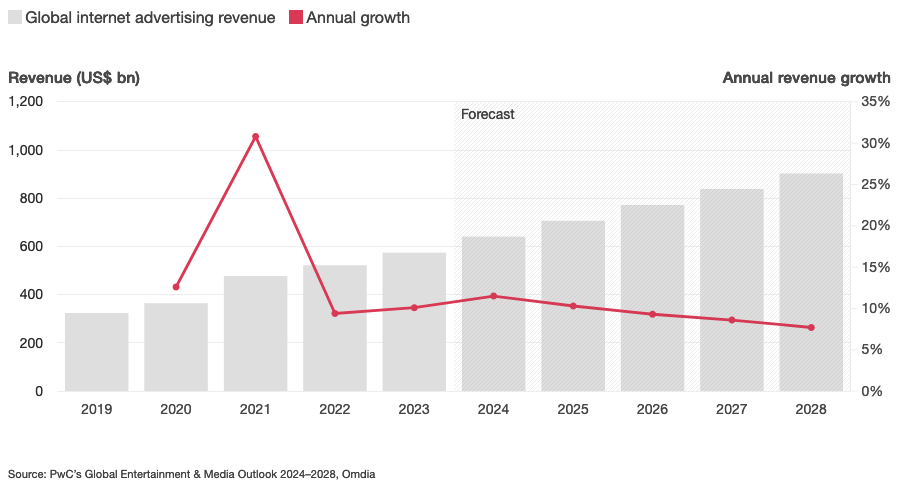

Google Search’s dominance is further bolstered by broader trends reshaping the digital economy. According to PwC’s Global Entertainment & Media Outlook 2024–2028 report, global digital advertising will account for 77.1% of total ad spending by 2028, growing at a 9.5% CAGR.

Retail and display ads on e-commerce platforms are expected to grow at an impressive 21.6% CAGR, reflecting advertisers’ focus on highly targeted and measurable campaigns, areas where Google AdSense and AdMob excel.

As more advertising dollars shift toward digital formats, Google’s ability to integrate search data, AI-driven targeting, and seamless connections between product discovery and purchase positions it well to capture the upside in the growing digital ad sector.

YouTube: Dominating Digital Video and Shaping the Future of Advertising

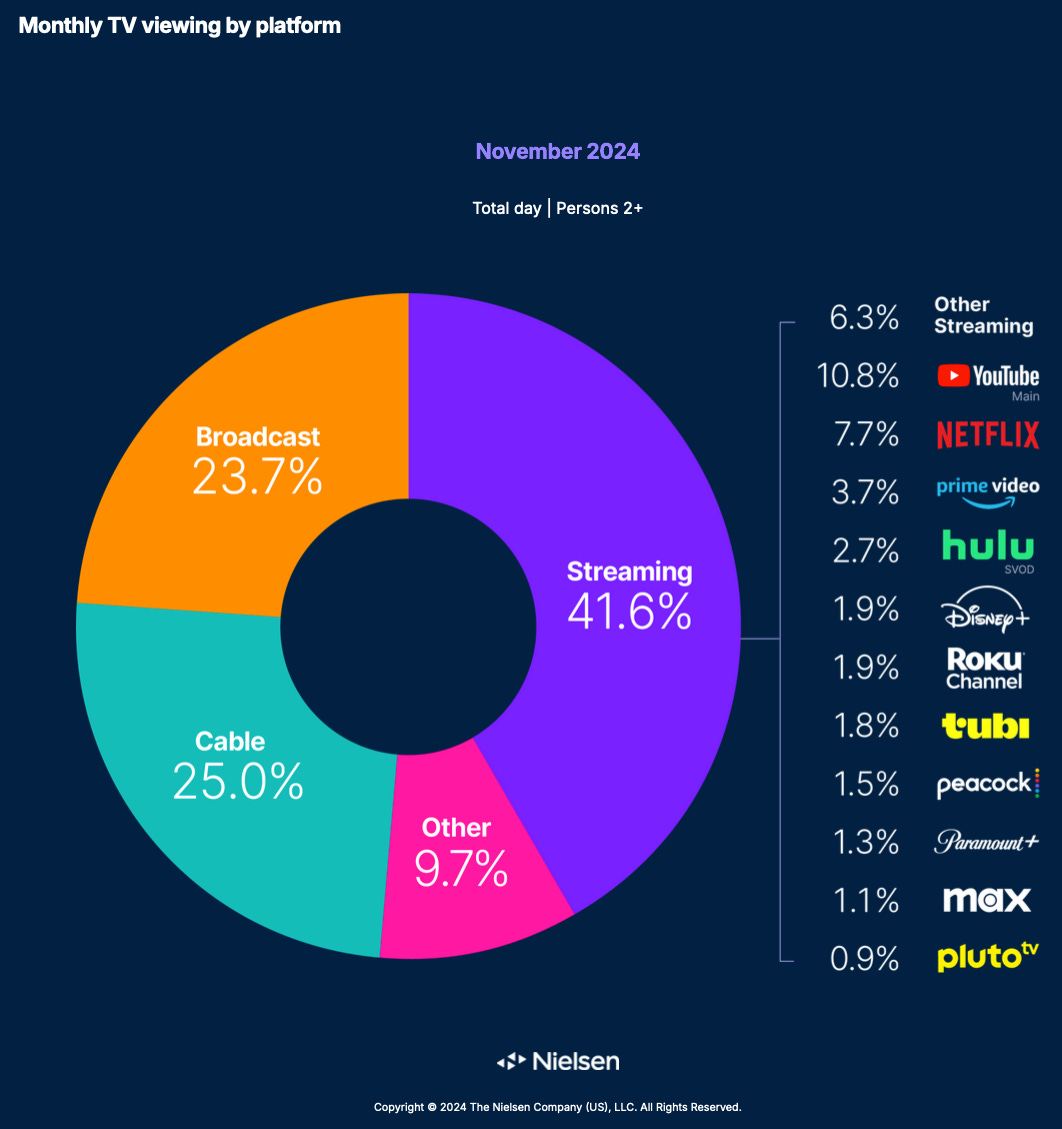

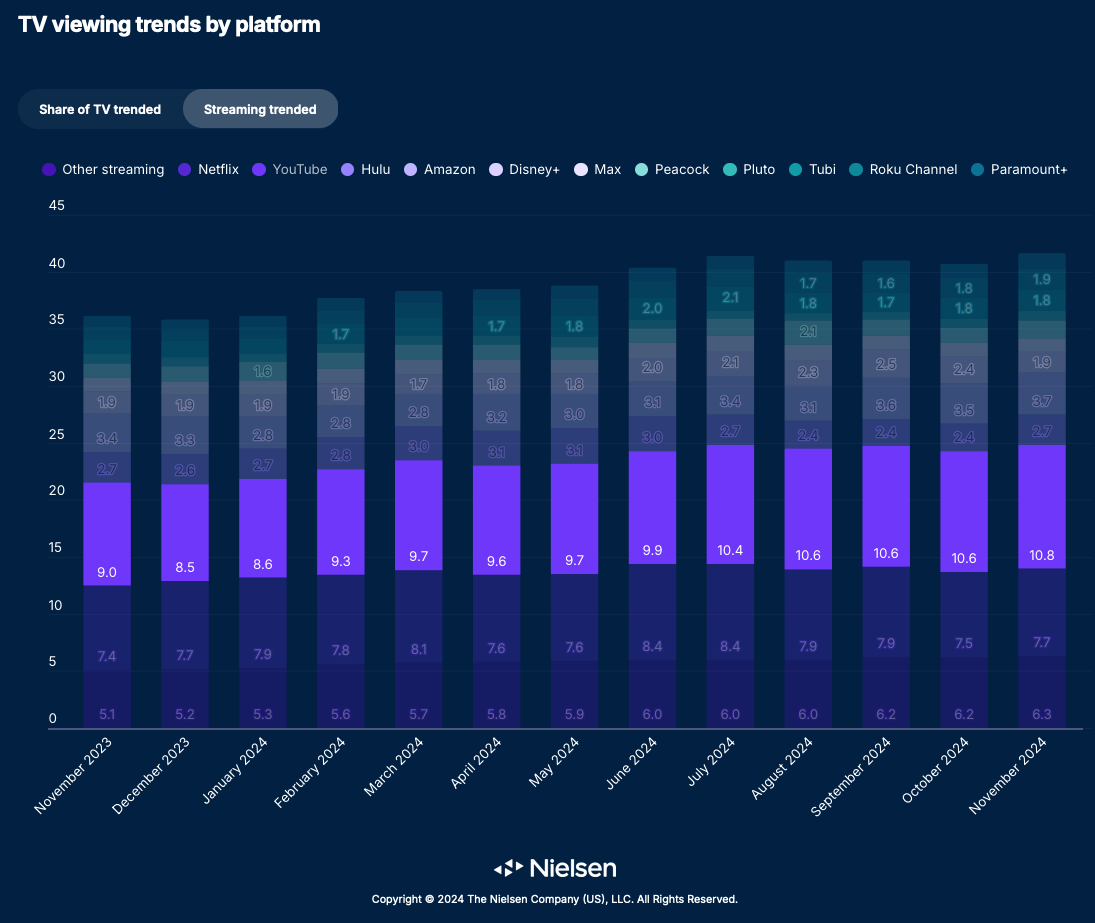

YouTube Ads, Alphabet’s second major ads-driven sector, contributed 10.25% of the company’s total revenue last year. As a global leader in video content and connected TV, YouTube has become a dominant platform for advertisers seeking both reach and engagement through targeted video campaigns. Its growth has been fueled by the expansion into new formats like YouTube Shorts and subscription-based services such as YouTube Premium, which enhance monetization opportunities and diversify revenue streams.

YouTube stands out as the best-positioned platform to capture shifting media trends, particularly as video emerges as the dominant form of content consumption across social media and streaming platforms. Unlike competitors focused solely on short-form videos, YouTube’s long-form-first approach attracts creators with higher production investment and stronger audience ties. This foundation allows YouTube to seamlessly host short-form content like Shorts, competing effectively with TikTok, while also supporting long-form programming, sports live streams, and even premium TV content.

With over 2.7 billion logged-in monthly users1, YouTube delivers unparalleled scale and audience engagement across devices, including connected TVs, where it already leads in screen time.

YouTube’s adaptability to new consumption habits, coupled with a rich creator ecosystem and expanding ad formats, positions it not only as a social media powerhouse but also as a streaming leader capable of capturing market share from traditional TV networks and other streaming platforms.

YouTube’s ability to evolve into a multi-faceted platform ensures its continued growth, with a 20% compound annual growth rate over the past five years, reinforcing its status as one of Alphabet’s most promising growth drivers in the near and medium term.

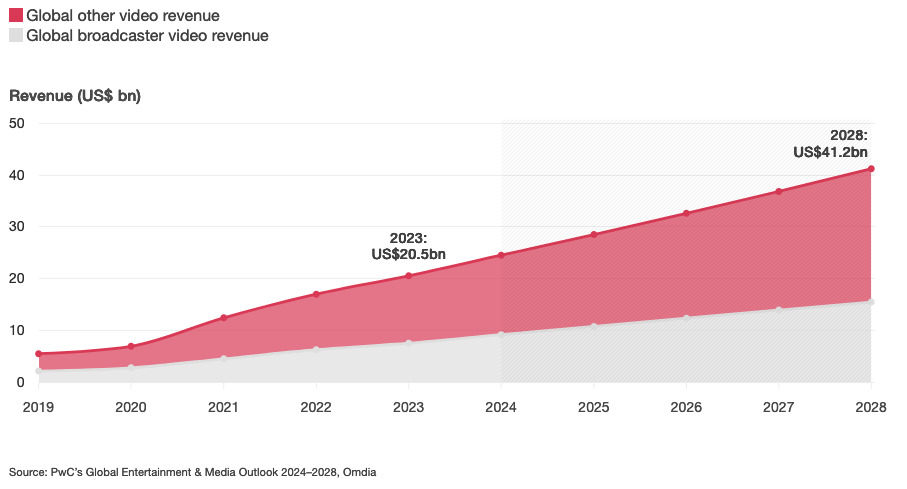

YouTube Ads’ segment also stands to benefit from the rise of global connected TV (CTV) advertising, projected to double to $41.2 billion by 2028.

Google Search and YouTube are continuously improved through recurring innovations, enhancing user value and attracting more advertisers: integrating features like Google Lens2 for visual searches and AI-driven advancements such as Google Gemini3 to offer more interactive and context-aware experiences. This commitment to innovation, paired with lightning-fast and reliable search results, has firmly established Google as the undisputed leader in the search market.

Google Network: Powering Ads Beyond Google’s Walls

Google Network, the third pillar of Alphabet’s ads-driven revenue, contributed 10.18% of total revenue in 2023. This segment generates income by placing ads on third-party websites and apps through platforms like Google AdSense and AdMob, allowing businesses to extend their reach beyond Google-owned properties.

A pivotal moment in the development of Google’s ad network was its 2007 acquisition of DoubleClick for $3.1 billion: This acquisition provided Google with cutting-edge ad-serving and tracking technologies, enabling it to offer advertisers and publishers highly efficient tools to manage and optimize digital ad campaigns. DoubleClick’s platform introduced sophisticated capabilities like programmatic advertising, where ads are automatically bought and sold in real-time auctions, vastly improving targeting precision and cost-efficiency.

Today, Google Network continues to benefit from the synergies of this acquisition, leveraging DoubleClick’s infrastructure to expand its reach and monetize inventory on millions of websites and mobile apps.

This segment complements Alphabet’s broader advertising strategy by capturing audiences outside Google’s direct platforms, ensuring advertisers can access users across the digital ecosystem while providing publishers with the means to effectively monetize their content.

Beyond Advertising: Google’s Subscriptions, Platforms, and Devices

What began as a company primarily reliant on Google Search for revenue has successfully diversified into multiple high-growth areas, creating a more robust and dynamic business model. Among these, the Google Subscriptions, Platforms, and Devices segment has emerged as a significant contributor to Alphabet’s revenue. This segment encompasses Google Workspace (formerly G Suite), hardware products such as Google Pixel smartphones and Nest smart home devices, and subscription services like Google One and YouTube Premium.

In 2023, this segment contributed 11.28% of Alphabet’s total revenue, compounding growth at 27.7% year-over-year over the past ten years and demonstrating growing adoption of cloud-based productivity tools and growing demand for premium subscription services. Google Workspace, in particular, has become a competitive player in the business productivity space, offering cloud-based solutions for collaboration, communication, and storage that rival Microsoft’s Office 365.

On the hardware front, devices like Google Pixel smartphones, Chromebooks, and Nest products have gained traction in their respective markets, appealing to consumers seeking seamless integration with the broader Google ecosystem. Meanwhile, subscription services such as Google One and YouTube Premium provide a recurring revenue stream, enhancing Alphabet’s overall financial stability and diversification.

Google Cloud: From Losses to Profitability and Beyond

Google Cloud’s journey to profitability has been a long and challenging road, marked by early missteps. Launched in 2008, just two years after Amazon Web Services (AWS), Google initially targeted advanced developers and overlooked the broader enterprise market’s needs. This focus on Platform-as-a-Service (PaaS) and cloud-native applications alienated potential customers who required hybrid solutions and support for legacy infrastructures. Despite steady growth, costs ballooned due to significant hiring and data center expenses, leading to annual losses exceeding $1 billion at times. Skeptics even questioned whether Google would eventually abandon its cloud business, as it had with previous ventures like Google Fiber and Google Hangouts.

A turning point came with the hiring of Thomas Kurian, a former Oracle executive, who implemented a strategic pivot. Recognizing its limitations in directly engaging enterprise clients, Google Cloud shifted to a partner-centric approach. By slashing marketplace commissions and emphasizing co-selling with partners such as Accenture, Deloitte, and Tata Consultancy Services, Google created an ecosystem that appealed to resellers, managed service providers, and software vendors. This strategy led to exponential growth in channel partner-driven sales and a 600% increase in clients spending over $1 million annually on Google Cloud Marketplace. By focusing on hybrid workloads, AI/ML applications, and vertical markets, Google leveraged its strengths in big data and global infrastructure to reposition itself. These efforts culminated in Google Cloud contributing 10.76% to Alphabet’s revenue in 2023 and achieving an impressive CAGR of 36.2% over the past five years.

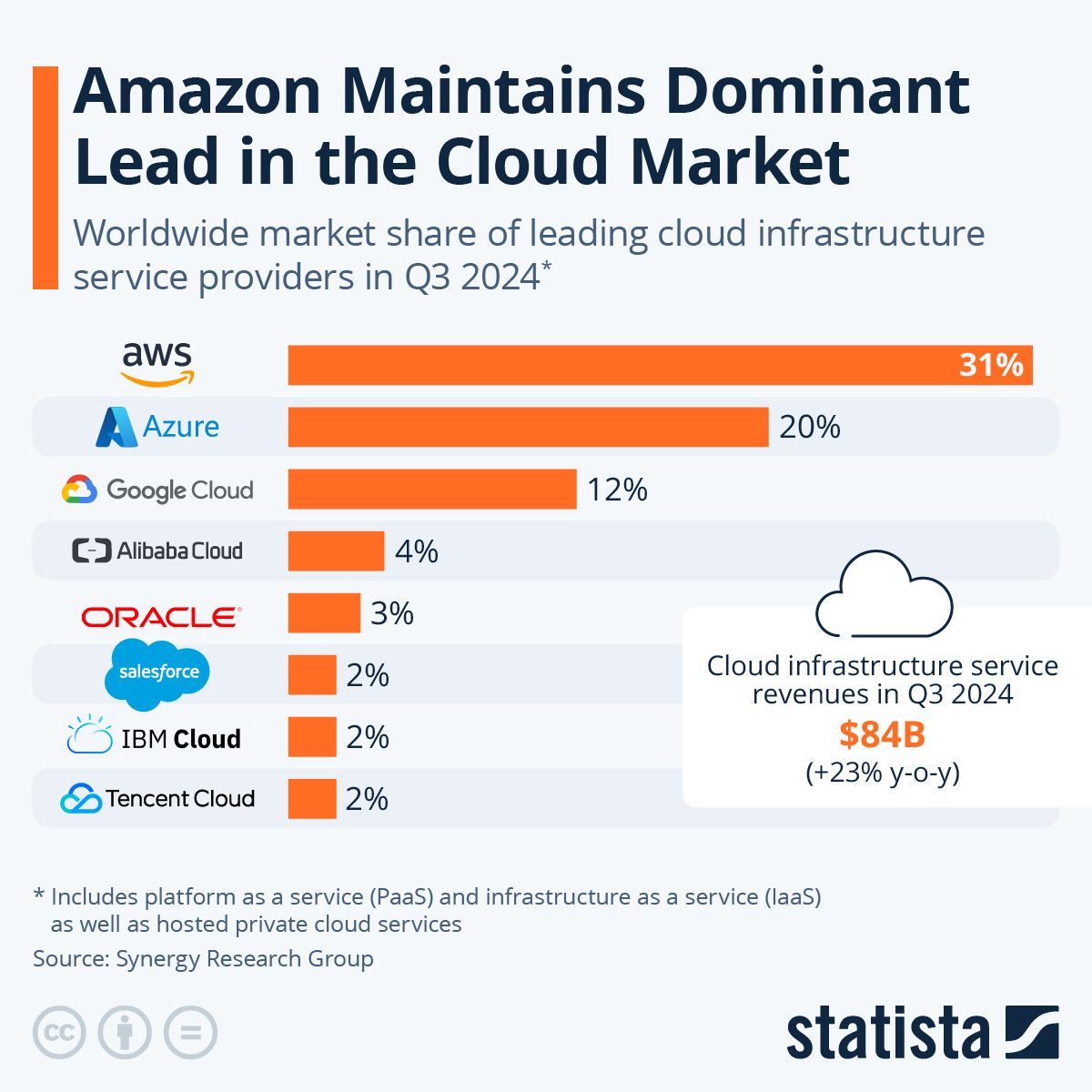

Google Cloud has positioned itself as the third-largest player in the global cloud infrastructure market, behind Amazon AWS and Microsoft Azure.

Unlike the winner-takes-all dynamics of online search, the cloud market allows multiple providers to thrive by offering differentiated solutions. Google Cloud’s focus on AI-powered tools and partnerships positions it as a strong contender, even as it competes with larger rivals like AWS and Azure.

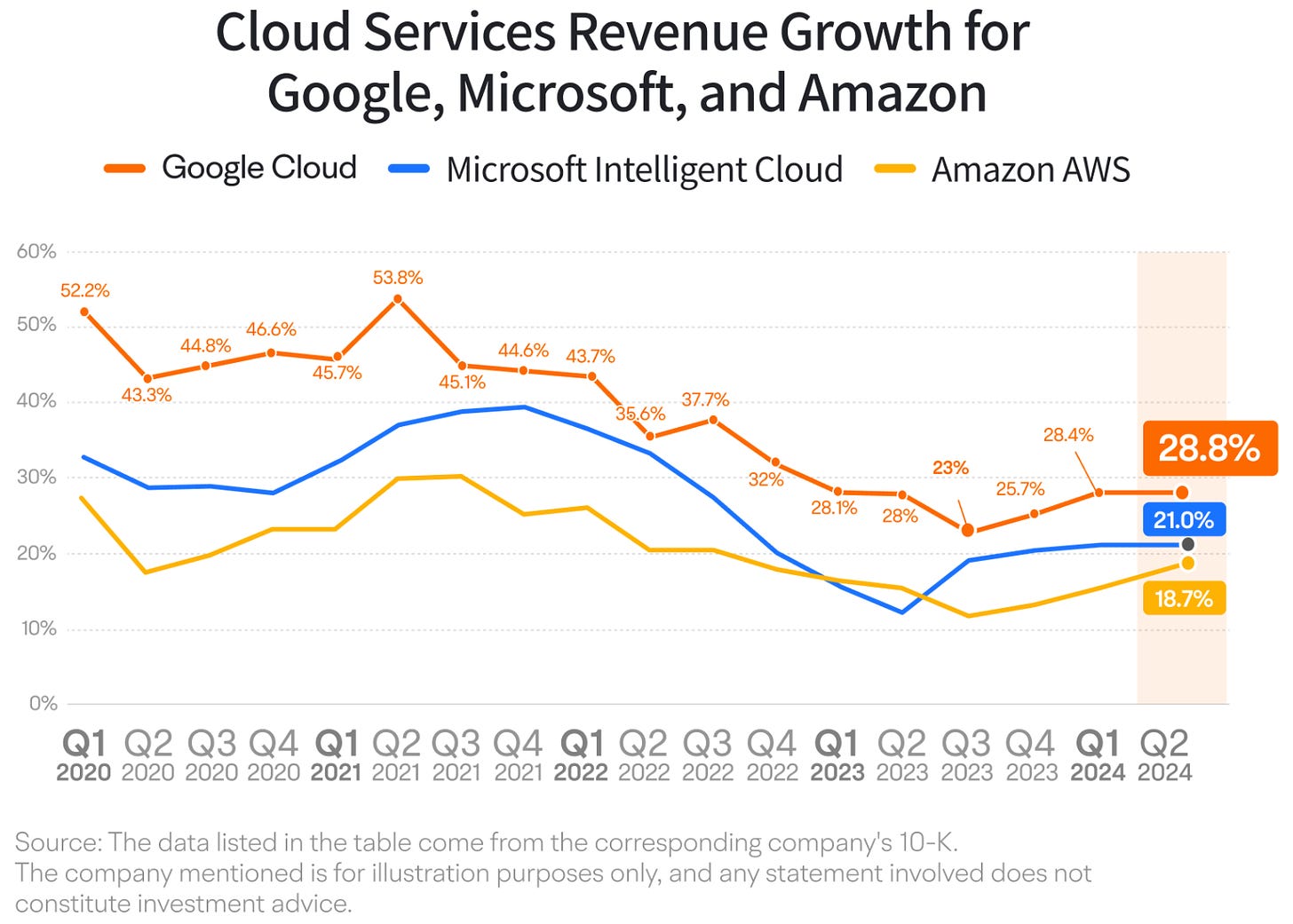

Starting from a relatively small base, Google Cloud consistently outpaces its competitors in growth, maintaining a leadership position with a 28.8% growth rate in Q2 2024. Microsoft Intelligent Cloud follows with 21%, while Amazon AWS, despite being the market leader in terms of scale, trails at 18.7% having reaccelerated growth in the last quarters. This data reflects Google Cloud’s rapid expansion. In contrast, Microsoft and Amazon are showing steadier but comparatively slower growth, emphasizing their already mature market positions. The narrowing growth gaps suggest intensifying competition in the cloud industry as players focus on expanding their services and capturing market share.

Notably, Google Cloud operated at a loss for 15 years before achieving profitability for the first time in Q1 2023, a milestone that signaled its transformation into a sustainable growth engine. Since then, Google Cloud has been growing revenue at 32.3% CAGR and expanding its operating income at an impressive 368.15% CAGR, reflecting its potential to become an even more significant driver of Alphabet’s long term success.

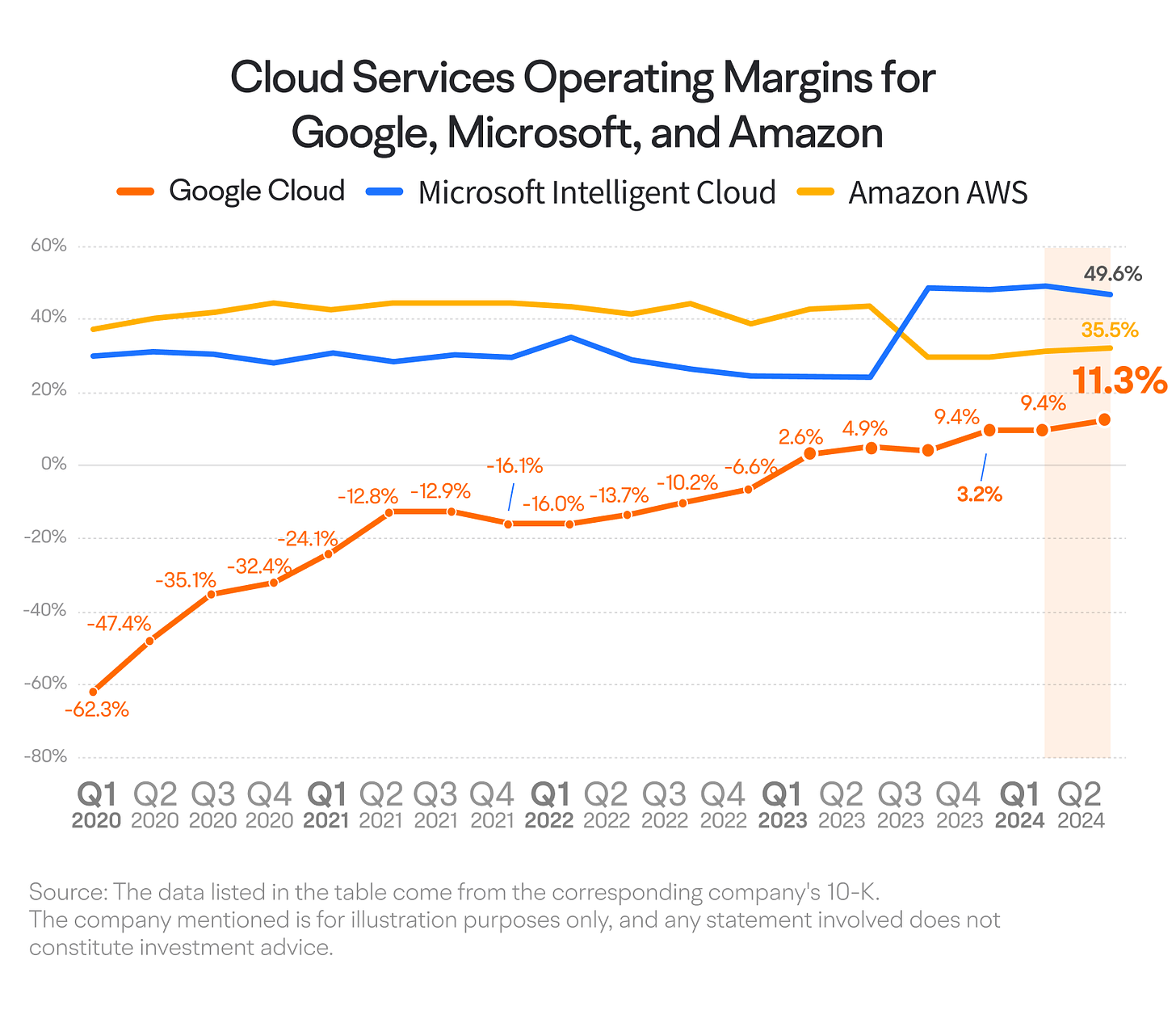

Google Cloud has been steadily improving the profitability of its operations, marking a significant turnaround since achieving profitability nearly two years ago. While this improvement marks a significant achievement for Google Cloud, its current margins remain far below those of its competitors. Amazon AWS leads with an impressive 49.6% profit margin, while Microsoft Intelligent Cloud follows at 35.5%.

If Google Cloud were to close the gap and achieve margins comparable to Azure or AWS, the impact on Alphabet’s bottom line would be transformative: With its $40.47 billion in trailing twelve months revenue as of Q3 2024 and continued growth in cloud adoption, increasing its operating margin to AWS’s level of 49% could quadruple its profitability, significantly enhancing Alphabet’s overall earnings. This would position Google Cloud as a vital contributor to Alphabet’s profit growth, accelerating the company’s ability to reinvest in innovation and other ventures.

As Google Cloud continues to expand its enterprise footprint and optimize operational efficiency, its trajectory indicates strong potential to narrow this margin gap, underscoring its growing importance in Alphabet’s portfolio.

Waymo and Other Bets: Alphabet’s Vision for the Future

Beyond Google, Alphabet oversees a portfolio of ventures collectively referred to as Other Bets, which exemplify the company’s commitment to long term innovation and exploration of transformative technologies. Among these, Waymo, the autonomous vehicle subsidiary, stands out as a leader in self-driving technology. As of December 2024, Waymo has expanded its robotaxi services to multiple U.S. cities including San Francisco, Los Angeles, and Phoenix, accumulating over 22.2 million autonomous miles4 and, in the process, gathering data to further enhance the safety of its autonomous driving vehicles.

Alphabet’s commitment to safety is evident in Waymo’s impressive performance metrics: A recent study comparing Waymo’s autonomous driving data to human benchmarks revealed that Waymo’s vehicles had 81% fewer airbag deployment crashes and 72% fewer injury-causing crashes compared to human-driven vehicles5. In a recent interview at the DealBook Summit, Alphabet CEO Sundar Pichai emphasized the significance of Waymo’s advancements, stating, “Our focus on safety and reliability in autonomous driving is paramount as we continue to scale our services across major cities”6. Alphabet’s first-mover advantage in the robotaxi sector, particularly in key U.S. cities, positions it well to capitalize on the growing autonomous vehicle market in the years ahead.

Other ventures under Alphabet’s Other Bets include Verily, which concentrates on life sciences and health solutions, and GV and CapitalG, the company’s venture capital arms that invest respectively in emerging startups and late-stage growth companies.

Collectively, these ventures currently contribute less than 0.5% to Alphabet’s total revenue in 2023 and operate at a combined annual loss of approximately $4 billion. Despite the financial challenges, Alphabet’s commitment to these high-risk, high-reward initiatives underscores its strategy to remain at the forefront of technological innovation and to explore new markets and engines of growth.

Alphabet’s Revenue Streams: From Ads to Emerging Growth Engines

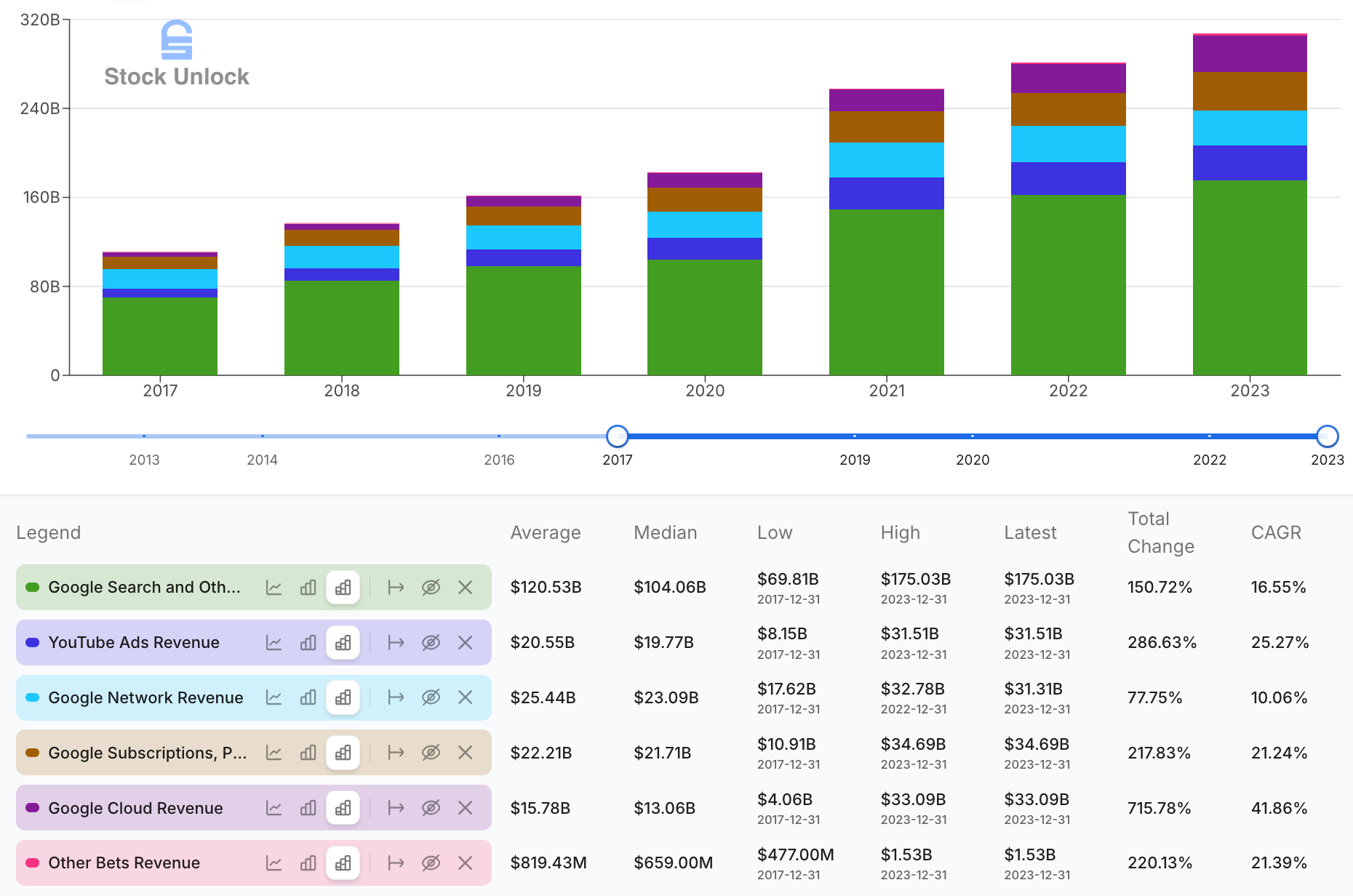

Between 2017 and 2023, Alphabet’s grew its total revenue at 18.52% CAGR, a remarkable growth rate for a mega-cap company. Over the same period, revenue streams evolved significantly, reflecting a shift in growth dynamics. While Google Search and Google Network remained the largest contributors, their growth slowed due to market maturity. Meanwhile, newer segments like YouTube Ads, Google Subscriptions, and Google Cloud emerged as key drivers of revenue growth.

YouTube Ads saw strong growth of 25.27% CAGR driven by rising video consumption and innovations, while Google Subscriptions gained traction with recurring revenue models and ecosystem integration growing at 21.24% CAGR over the same period. Google Cloud, with an impressive CAGR of 41.86% over the past seven years, transitioned from years of losses to profitability in early 2023, underscoring its importance as a sustainable growth engine.

Alphabet’s ability to diversify and adapt its business model ensures its resilience, with newer segments driving growth while traditional segments remain steady cash cows for reinvestment.

While Alphabet’s top-line growth demonstrates its ability to scale, evaluating its profitability across segments provides deeper insights into its financial efficiency.

From Revenue to Profit: Alphabet’s Key Bottom-Line Engines

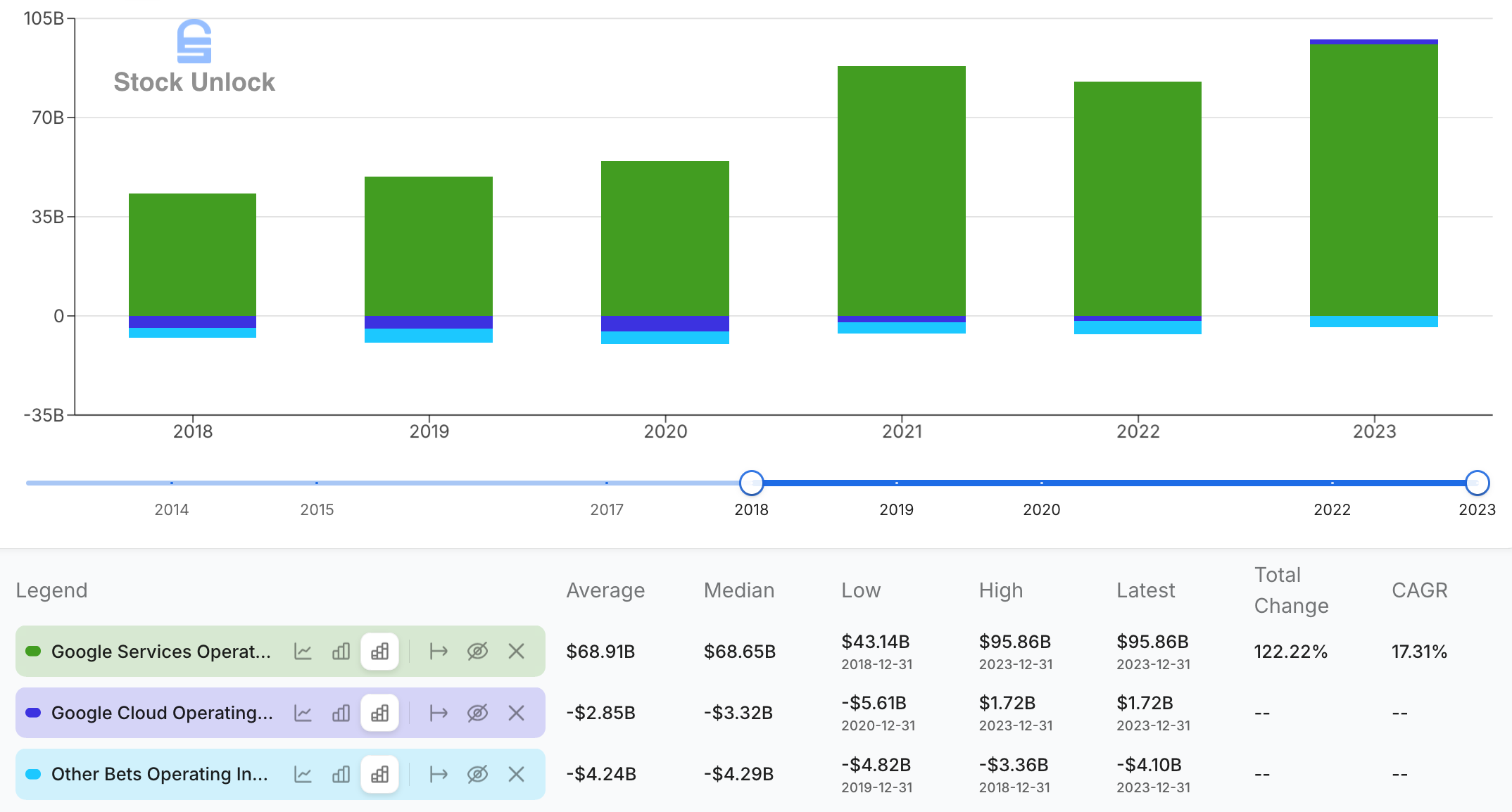

Alphabet’s profitability is driven by its high-margin segments, with Google Services serving as the core earnings engine. Google Services encompasses the combined profits from Google’s three advertising segments (Search & Other, YouTube Ads, and Google Network) as well as its Subscriptions, Platforms, and Devices segment.

Google Search & Other: Alphabet’s primary profit center, fueled by economies of scale, advanced algorithms, and data-driven optimization. Despite moderating growth, it continues to deliver stable cash flow to fund expansion.

YouTube Ads: Rising video consumption and premium ad rates have made YouTube a meaningful contributor, with innovation like YouTube Shorts enhancing profitability, albeit at slightly lower margins than Search.

Google Network: Historically profitable through AdSense and AdMob, its impact has diminished as growth slowed.

Google Cloud: Once unprofitable, Google Cloud turned profitable in early 2023 and generated $4.88 billion in operating income in the trailing twelve months to Q3 2024. With margins improving toward peers like AWS, it would position Google Cloud as a growing profit driver.

Subscriptions, Platforms, and Devices: Recurring revenue streams, such as Google Workspace and YouTube Premium, are gaining traction, though hardware margins remain relatively low.

Other Bets: Ventures like Waymo and Verily continue to operate at a loss (-$4.1 billion in 2023) but represent long-term growth potential.

Overall, Google Services contributed the bulk of operating income, growing from $43.14 billion in 2018 to $95.86 billion in 2023 at a 17.3% CAGR. Meanwhile, Google Cloud’s profitability signals emerging growth, while Other Bets remain a drag on margins.

Alphabet’s ability to generate substantial profit, even as it reinvests in growth and innovation, highlights the balance it strikes between short term profitability and long term value creation.

Alphabet’s Operational Efficiency and Profitability

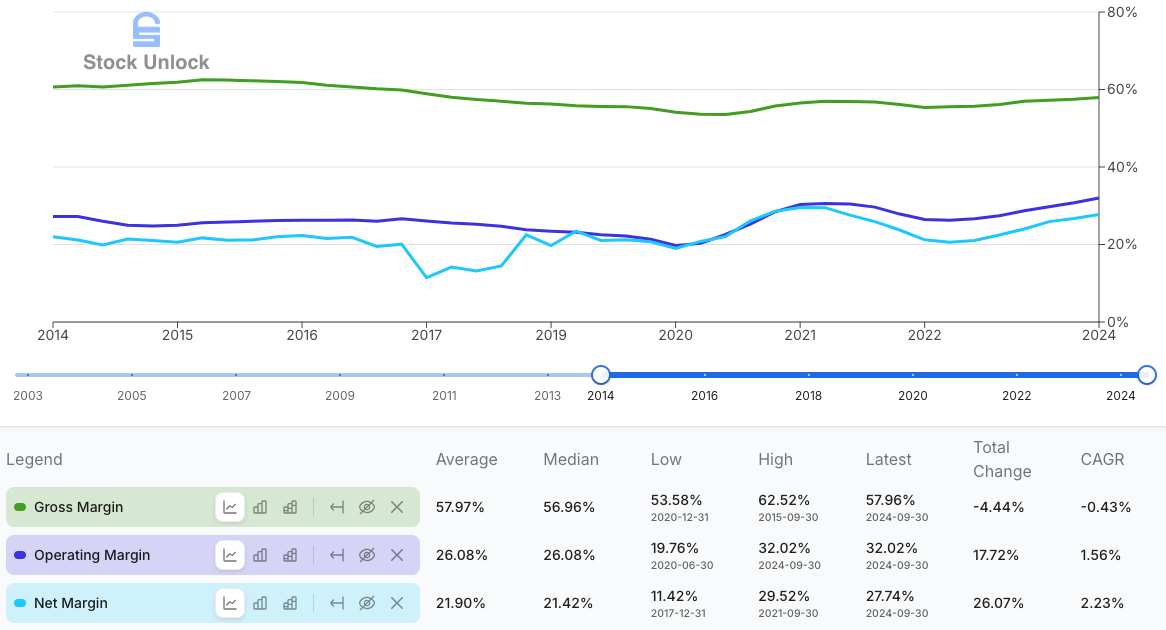

Alphabet’s margins reflect the strength of its core business and its ability to generate substantial profits while funding innovation and growth. Since 2014, the company’s gross margin, consistently near 57%, underscores the high efficiency of its flagship Google Services segment, which includes high-margin products like Google Search and YouTube ads. Alphabet’s 32% operating margin reflects strong cost management and improving profitability in segments like Google Cloud. Despite high investments in AI and infrastructure, the company maintains impressive 27.74% net margins, balancing growth with profitability.

Alphabet’s focus on cost discipline has driven margin expansion: Over the past decade, both operating and net margins have shown steady improvement, underscoring Alphabet’s increasing efficiency in managing costs and translating revenue into profit. This trend highlights the company’s ability to optimize its operations and consistently deliver greater value to its bottom line.

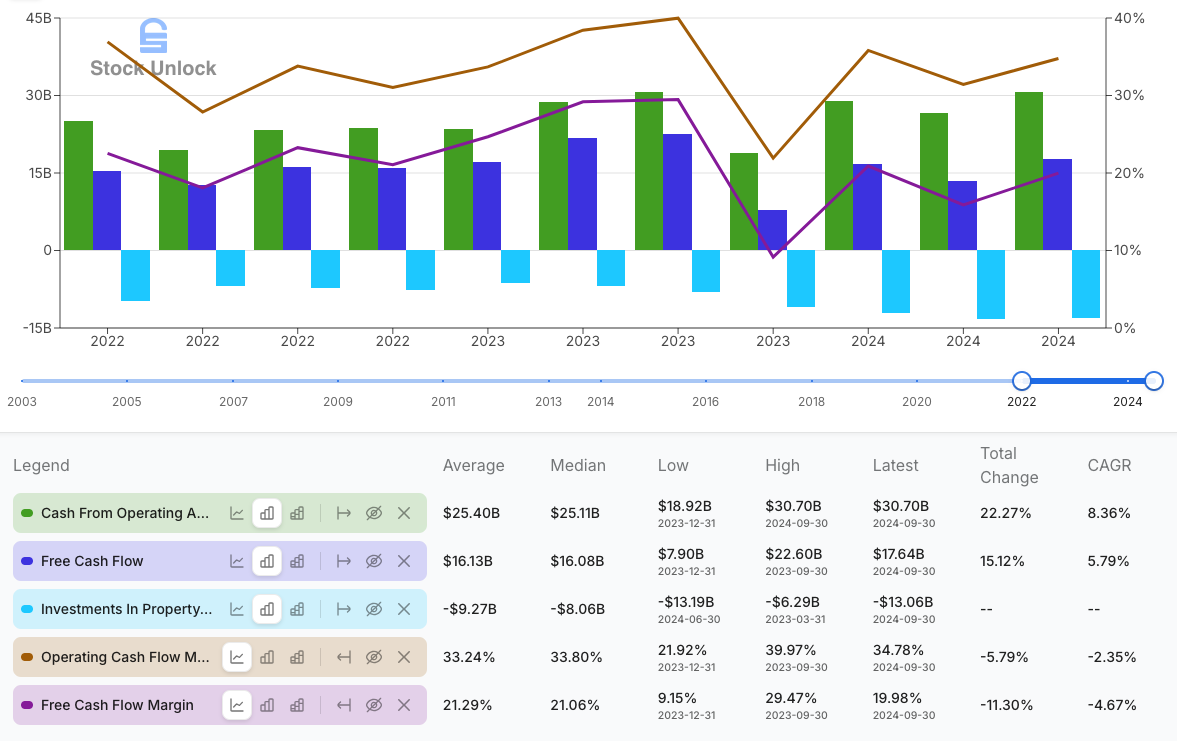

Over the past three years, Alphabet’s operating cash flow has grown at a respectable 8.36% year-over-year, averaging $25.4 billion a quarter, with a recent high of $30.7 billion in Q3 2024. This steady cash flow has supported significant capital expenditures (CapEx), averaging $9.27 billion a quarter, as Alphabet continues to invest heavily in infrastructure, data centers, and AI capabilities to drive future growth. Despite rising CapEx, free cash flow (FCF) has remained solid, averaging $16.13 billion a quarter. However, Alphabet’s free cash flow margin has experienced some pressure, declining from a high of 29.47% in Q3 2023 to a more recent 19.98% in Q3 2024, reflecting these higher investments.

“We believe strongly that in the long term, we will be better served-as shareholders and in all other ways-by a company that does good things for the world even if we forgo some short term gains.”

— Larry Page and Sergey Brin, Google Founders’ IPO Letter

I fully support Alphabet’s strategic decision to prioritize long term growth by reinvesting heavily in growth opportunities, even at the expense of short-term free cash flow. This forward-looking approach demonstrates a commitment to strengthening and expanding its business segments, laying the foundation for greater profitability and sustainable value creation in the future.

Furthermore, over the past decade, Alphabet has maintained an average return on invested capital (ROIC)7 above 19%, reflecting its consistent ability to generate attractive returns on its investments. Notably, ROIC has accelerated since Q1 2021, reaching a near all-time high of 30.37% as of Q3 2024. This underscores Alphabet’s disciplined long term reinvestment capital allocation and reinforces confidence in its strategy to drive long term growth and profitability.

Alphabet’s Balance Sheet: A Symbol of Financial Health

With a massive cash reserve, minimal debt, and a strong equity base, Alphabet is well-positioned to navigate economic challenges, fund growth initiatives, and sustain its competitive advantage in the ever-evolving technology-driven sectors that it operates in. Alphabet manages its balance sheet prudently, even as it pursues aggressive investments in cloud and AI to fuel growth, demonstrating its financial discipline and ability to balance innovation with stability.

Cash and Marketable Securities

Alphabet consistently maintains a substantial cash reserve, which stood at over $93.23 billion as of Q3 2024. This liquidity provides the company with unparalleled flexibility to fund ambitious growth initiatives, such as AI and cloud infrastructure, pursue strategic acquisitions, and return capital to shareholders through share buybacks or dividends. Since 2015 Alphabet’s board of directors regularly approves large share buyback programs and in Q3 2024 they have instated a dividend policy, both capital allocation decisions that I disagree with and I will cover in a later article.

Like other company with high cash reserves, Alphabet’s cash position also acts as a buffer against economic uncertainties and competitive pressures, ensuring stability even during challenging periods.

Low Leverage and Minimal Debt

Alphabet’s balance sheet is notably light on debt ($14.67 billion as of Q3 2024), with a debt-to-equity ratio consistently below 0.5 over the past decade. This conservative capital structure reflects the company’s ability to generate sufficient cash flow to fund its operations and growth without relying heavily on external financing. The limited reliance on debt also minimizes financial risk and interest expenses, enabling Alphabet to allocate more resources toward innovation and expansion.

Liabilities and Shareholder Equity

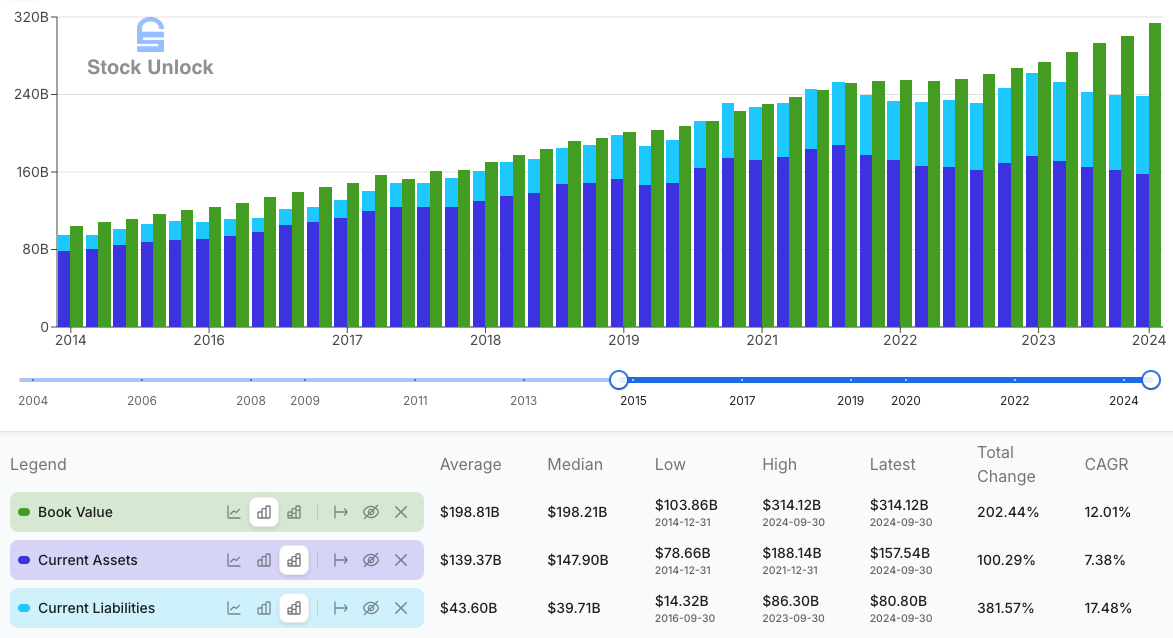

Alphabet’s liabilities are well-managed, with total liabilities constituting less than 27% of total assets as of Q3 2024. The company’s low leverage and strong equity base underscore its financial prudence and stability. Shareholder equity (book value), which exceeds $314 billion, has grown consistently over the past ten years at a 12% CAGR. Moreover, Alphabet’s current ratio of 1.95 highlights its ample liquidity, ensuring it can comfortably meet short-term obligations while continuing to invest in growth opportunities and strategic initiatives without financial strain.

From Pandemic Boom to Recovery: Alphabet’s Journey Through 2020–2024

During the COVID-19 pandemic, user engagement across Google’s products surged. Search traffic and YouTube watch time increased substantially, app downloads from Google Play rose by 30% in March 2020, and Chromebook sales quadrupled as people adapted to remote work and learning. Google Meet experienced an extraordinary thirty-fold rise in usage, underscoring the platform’s critical role during the crisis and its long term potential.

However, Google’s advertising revenue faced significant challenges: Advertisers in key sectors like travel, retail, and entertainment cut back spending sharply, while search volume shifted toward less monetizable topics such as COVID-19 information, resulting in lower ad prices and revenues. By March 2020, Google Search revenue had declined by mid-teens year-over-year, while YouTube and Google Network ad revenues also slowed. Nevertheless, YouTube’s direct-response advertising proved resilient compared to brand advertising. Furthermore, Alphabet’s increased financial disclosures in 2021, particularly regarding the performance of YouTube and Google Cloud, provided greater visibility into these emerging growth engines.

Despite the impact on advertising revenue and Google’s largely fixed cost structure, the company remained profitable and cash flow positive. The shift to digital technologies during the pandemic reinforced Alphabet’s relevance in a rapidly evolving landscape. By 2021, Google’s revenue growth surged to an impressive 41% year-over-year, while operating income skyrocketed by 91%.

These exceptional financial results proved unsustainable. By Q4 2022, revenue growth had flat-lined, and ballooning costs, driven by hiring plans and budgets based on earlier growth trends, caused a 17% decline in operating income year-over-year for 2022. This marked a modest but unusual setback for Alphabet.

Since late 2022, Google has worked to regain momentum. Cost-cutting efforts, described by then-CFO Ruth Porat as a “durably reengineer cost base” played a critical role. A combination of 8.88% compound annual growth in revenue and disciplined expense management helped Google’s operating income grow by 31.3% year-over-year from Q1 2023 to Q3 2024, signaling a clear recovery from its post-pandemic slump.

Reflecting on this period, mid-2020 marked the beginning of my research into Alphabet as I followed the company’s pandemic-driven growth and its impressive ability to weather short-term headwinds. However, it wasn’t until two and a half years later, in late 2022, that I felt ready to initiate a position. The process of observing Alphabet’s resilience, adaptability, and ability to sustain profitability during volatile times played a crucial role in building my conviction. Alphabet made it into my investable universe early, but it took time for me to develop the confidence to act decisively, an approach that I believe reflects the importance of patient, informed investing.

Alphabet in My Portfolio: A Journey of Growth and Conviction

I hold shares in Alphabet, having initiated my position on December 29, 2022, at a share price of $86.68. This purchase came during a period in late 2022 when tech-driven companies faced significant challenges, including rising interest rates, inflation, and post-pandemic demand normalization. The Federal Reserve’s aggressive rate hikes lowered growth stock valuations, while slowing consumer spending and weaker earnings dampened sentiment. I previously covered these events and their broader economic impact in an earlier article.

Many investors rotated to traditional value stocks, widespread layoffs signaled industry-wide recalibration, and regulatory pressures combined with geopolitical tensions further weighed on valuations.

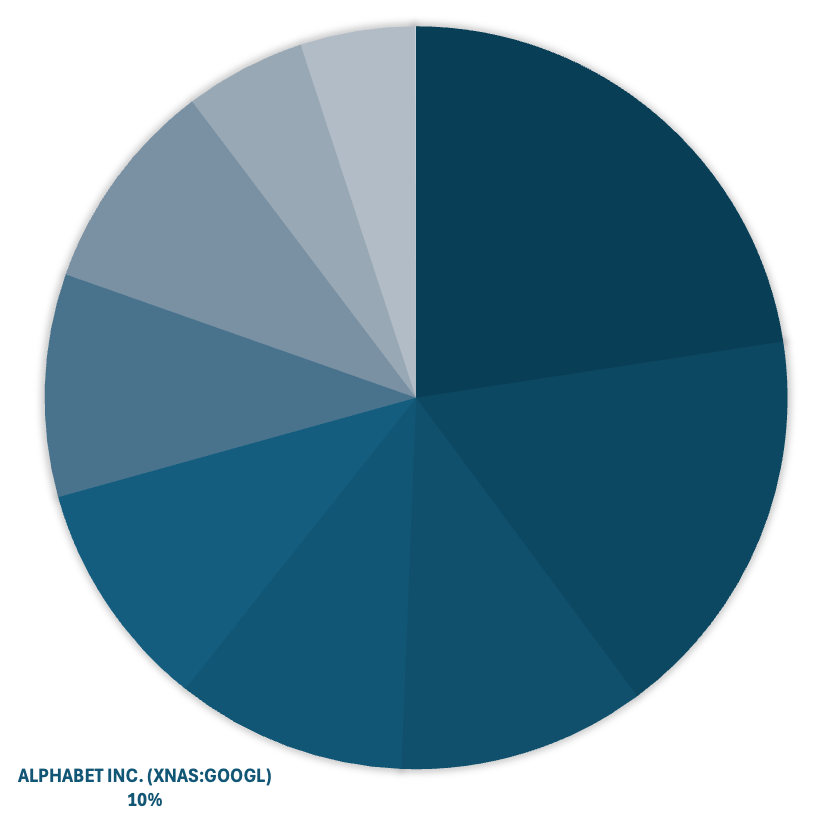

These factors led to sharp discounts in tech-driven companies’ stock prices, including Alphabet, despite its strong fundamentals and long term potential: Alphabet was selling at a Free Cash Flow (FCF) yield of 5.24%, implying a P/FCF ratio of 19 (a 30% discount to Alphabet’s 10-year average market capitalization relative to free cash flow of 27.7), which compared favorably to the 3.71% yield on the U.S. 10-year Treasury bill, the risk-free rate. Since then, my conviction in the company has deepened, prompting me to increase my allocation. My current cost basis stands at $139.52, with Alphabet now comprising 10% of my portfolio.

How Have I Fared Investing in Alphabet Over the Past Two Years?

Evaluating an investment by focusing on a company’s fundamental progress offers a more meaningful metric than fixating on stock price movements. Market fluctuations over a short period, such as two years, hold little bearing on my investment decisions. Instead, I monitor the company’s ability to innovate, adapt, and widen its moat, which ultimately determine its intrinsic value. Improvements in products, integration of technologies like AI, expansion into new markets, and operational efficiency often precede financial performance, creating enduring value. By prioritizing business’ fundamental progress, I aim to maintain a long term perspective, ensuring that short-term market noise does not distract me from its fundamental progress.

This perspective is especially important when considering that most of Alphabet’s stock returns over the past two years have come from multiple expansion rather than underlying growth: While Alphabet’s free cash flow has declined at a -4.05% CAGR, its P/FCF ratio has grown at a 51.7% CAGR during the same period. At the time of my initial purchase, Alphabet’s valuation was considerably below its 10-year average, making some degree of multiple expansion expected. However, this illustrates why relying on short-term stock price movements bears no meaningful insight to evaluate my decision to invest in the company.

While my money-weighted rate of return (MWRR)8 as of December 23, 2024 stands at 58.61%, I view this as a byproduct of favorable market dynamics rather than a reflection of the company’s intrinsic value growth over such a short period. Alphabet’s ability to reinvest in growth opportunities and expand its business segments are far more important indicators of future performance than short-term stock price movements.

Alphabet’s Fundamental Progress In 2023

Since December 2022, Alphabet has demonstrated robust growth and innovation across its products and services, underpinned by strong financial performance.

In 2023, Alphabet celebrated its 25th anniversary, reflecting on its mission to “organize the world’s information” and its impact over the past quarter-century. Significant advancements were made in AI integration across products like Search, Workspace, Cloud, and YouTube, strengthening its competitive edge: New AI-powered ad formats enhanced targeting and conversions, while 70% of generative AI startups were Google Cloud clients, underscoring its strength in AI infrastructure.

Financially, Alphabet reported robust growth, driven by its core advertising business, previously obscured by post-pandemic slowdowns, and Google Cloud turning profitable. Growth for Google Search was bolstered by the recovery in the ad market and adoption of tools like Performance Max for automated ad campaigns. The company reported revenues of $307.39 billion, a 8.68% increase from 2022. Operating income stood at $88.23 billion, with a net income of $73.8 billion, a 23.05% increase from 2022, reflecting strong profitability. Alphabet converted to cash $69.5 billion of its profit, a 15.81% year-over-year. To streamline operations, the company implemented workforce reductions and optimized global office space, incurring combined charges of $3.9 billion.

Alphabet’s Fundamental Progress In 2024

In the first nine months of 2024, Alphabet’s earnings calls emphasized its focus on integrating AI across its ecosystem, driving growth in Search, Cloud, and YouTube: CEO Sundar Pichai highlighted how generative AI, such as Google Gemini, enhances user engagement and bolsters competitiveness.

Alphabet’s AI strategy also took center stage during Google’s I/O developer conference, where the company announced the rollout of AI Overviews for its core Google Search product. Google Cloud emerged as a key growth driver, with strong enterprise adoption and profitability milestones, underscoring its role as a sustainable revenue engine. Although I can’t yet enable AI Overviews on my Google Account, Alphabet planned to scale AI Overviews to over 1 billion users globally by year-end. This rapid deployment is supported by Alphabet’s proprietary infrastructure, which has been optimized for AI workloads over a decade. Notably, compute costs for AI Overviews have declined over 90% year-over-year, reflecting Alphabet’s technical efficiency and cost discipline.

Operational efficiency remained a priority, with cost optimization enabling reinvestment into high-growth areas like AI and Cloud. YouTube continued to expand through YouTube Shorts, Premium subscriptions, and connected TV, capturing ad spend from traditional and digital platforms.

As of Q3 2024 Waymo handles 150,000 weekly paid rides and 1 million fully autonomous miles, signaling scalability and real-world adoption. Management reiterated Alphabet’s commitment to long term innovation, positioning initiatives like Waymo as crucial future growth bets.

Overall, Alphabet balanced efficiency with ambitious growth, reinforcing its leadership in the advertising, cloud computing, AI and next frontiers sectors.

Conclusion

Alphabet stands as a testament to innovation, adaptability, and disciplined growth. Its competitive moats, leadership in AI, and diversification across segments ensure resilience in a dynamic market. As this series continues, I will analyze Alphabet’s approach to overcoming challenges, capital allocation strategies, and valuation insights, building a comprehensive case for its potential as a long term compounder.

YouTube Statistics 2024 (Demographics, Users by Country & More) by GlobalMediaInsight

Google Lens was officially released on October 4, 2017, during the announcement of the Pixel 2 and Pixel 2 XL smartphones. Initially, it was available exclusively on Google Pixel devices but was later rolled out to other Android and iOS devices, becoming widely accessible through the Google Photos app and Google Assistant.

Google Gemini is Google’s next-generation AI model that integrates advanced generative AI capabilities with deep language understanding and multimodal processing. Designed to power a range of applications, including conversational AI, search enhancements, and creative tools, Gemini represents a significant leap in Google’s AI capabilities, blending text, image, and other data types to deliver more interactive, context-aware, and versatile experiences across its ecosystem.

Waymo Safety by Waymo LLC

Google’s Sundar Pichai on Antitrust, Trump and A.I. by The New York Times

Return on Invested Capital (ROIC) is a profitability metric that measures how efficiently a company generates returns from its invested capital, including both equity and debt. It reflects a company’s ability to create value by reinvesting in its business and is often used to evaluate long term performance and competitive advantage.

Money-Weighted Rate of Return (MWRR) measures the performance of an investment while accounting for the size and timing of cash flows, such as contributions and withdrawals. It calculates the internal rate of return (IRR) that equates the present value of cash inflows and outflows with the ending value of the investment, reflecting the actual return experienced by the investor based on capital deployed over time.