Amazon's Q4 2024 Earnings and 2025 Outlook: Strong Results, Big Investments, and Future Growth

Why Amazon remains my top holding amid market skepticism

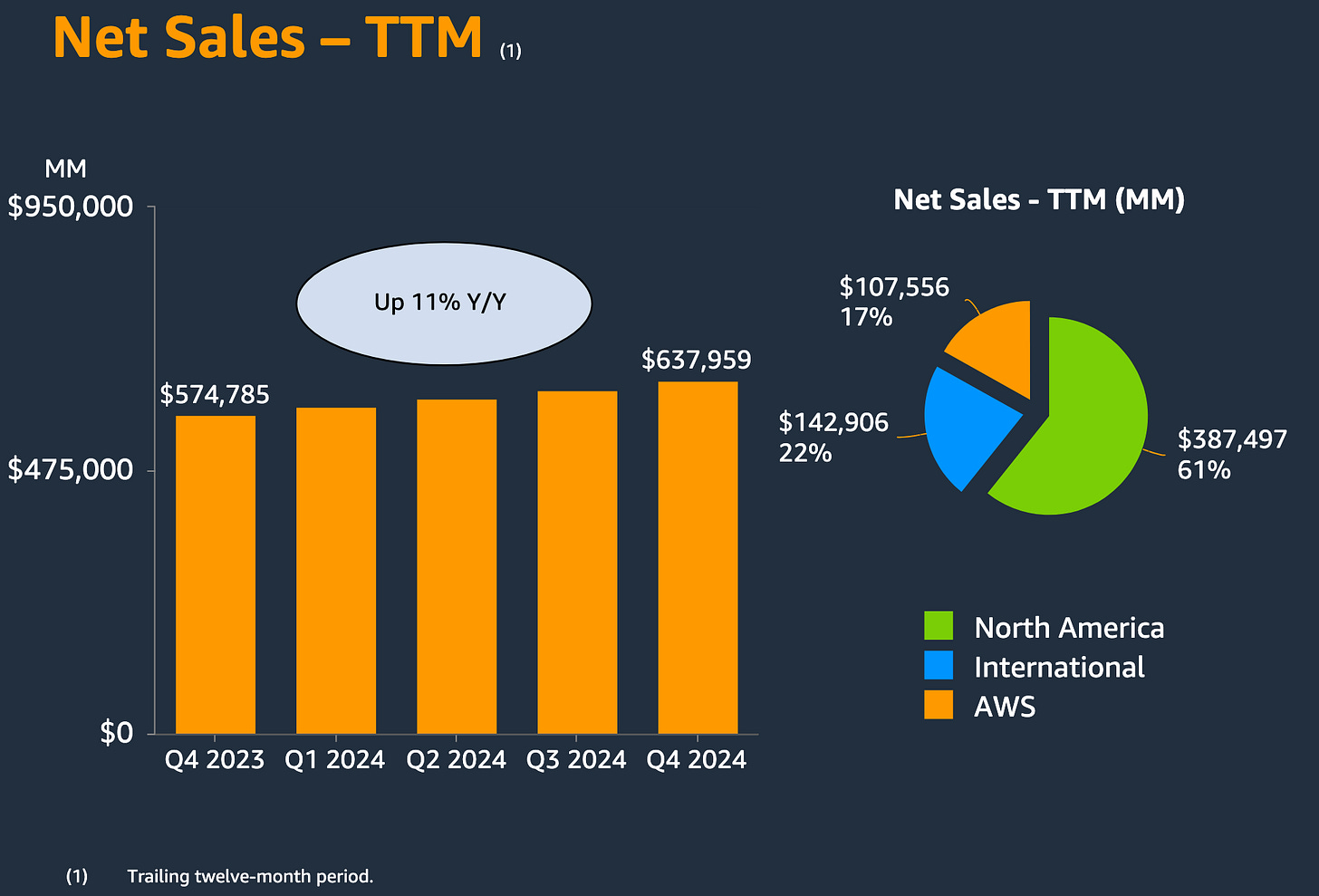

Amazon.com Inc. (AMZN 0.00%↑) reported its Q4 2024 earnings and FYE 2024 results (earnings’ slides) last Thursday, delivering strong financial results, yet the market reacted negatively, sending the stock down by approximately 3% in after hours closing the next day down 4%.

The market’s reaction was likely driven by Amazon’s announcement of over $100 billion in capital expenditures for 2025 and a somewhat muted Q1 2025 guidance. In this article, I analyze Amazon’s financial performance, its business segments, and why I remain bullish despite near-term headwinds.

Strong Financial Performance

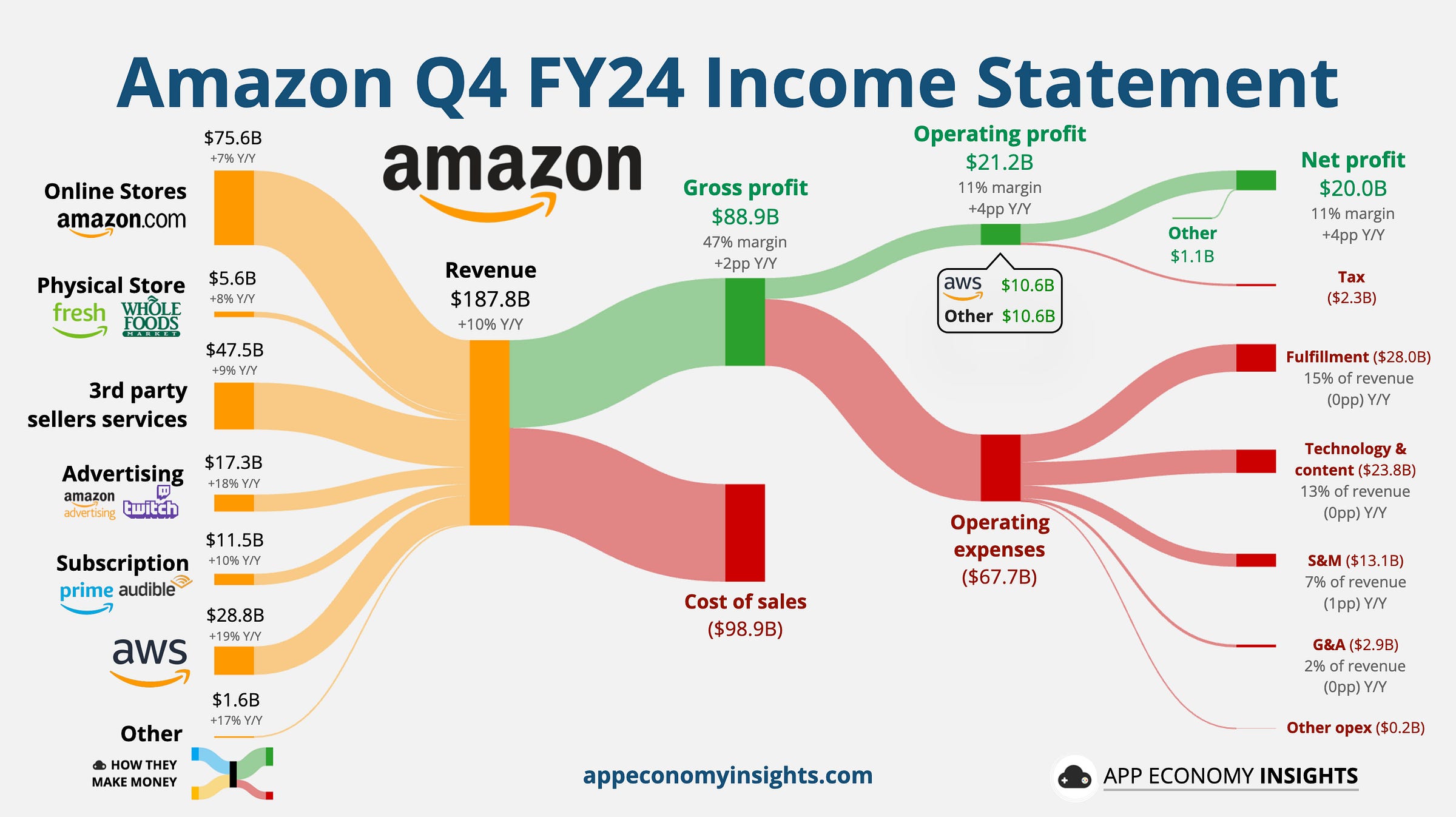

Amazon reported Q4 net sales of $187.8 billion, reflecting a 10% year-over-year (YoY) increase. During the Q4 earnings call, Amazon’s CEO, Andy Jassy, remarked:

“Without that [FX] headwind, revenue would have exceeded the top end of our guidance.”

This highlights a geographically diversified nature of Amazon’s business which I see as a competitive advantage, not a headwind. Here’s a breakdown by geography:

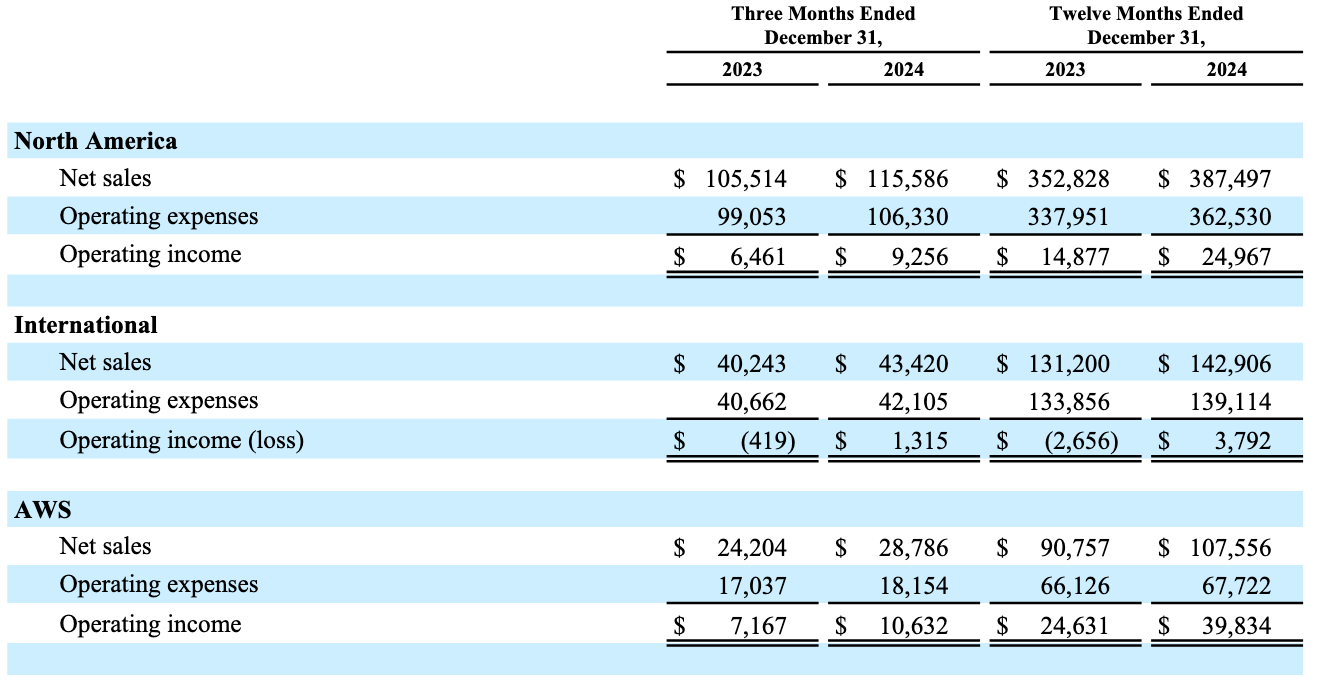

North America sales: Up 10% YoY to $115.6 billion.

International sales: Up 8% YoY to $43.4 billion.

AWS sales: Up 19% YoY to $28.8 billion.

More importantly, operating income surged to $21.2 billion, up from $13.2 billion in Q4 2023, a YoY increase of 60.6%. AWS contributed significantly, reporting $10.6 billion in operating income, a 48% increase from the prior year.

For the full year, Amazon achieved $638 billion in net sales, an 11% YoY growth, while AWS surpassed $100 billion in annual revenue for the first time.

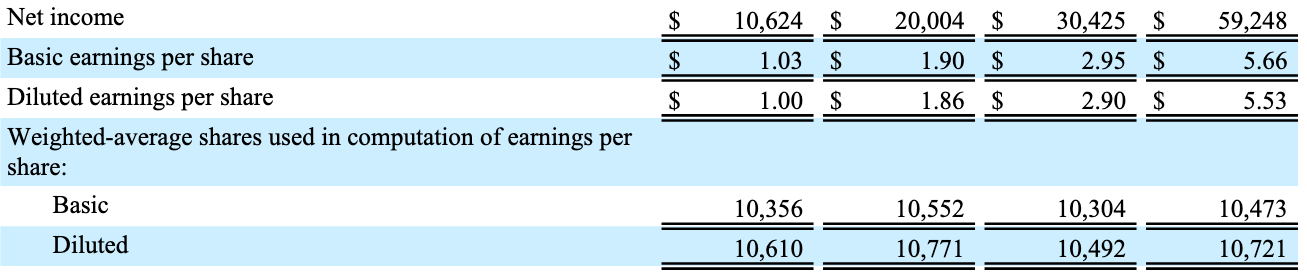

Operating income grew 85.9% YoY from $36.9 billion to $68.6 billion with net income nearly doubling to $59.2 billion from the prior year. In turn, the company’s earnings per share (EPS) showed remarkable growth in 2024, increasing from $2.90 in 2023 to $5.53, representing an impressive 90.7% YoY rise. This significant improvement in profitability occurred despite a modest 1% increase in the share count, which rose from 10.49 billion to 10.72 billion.

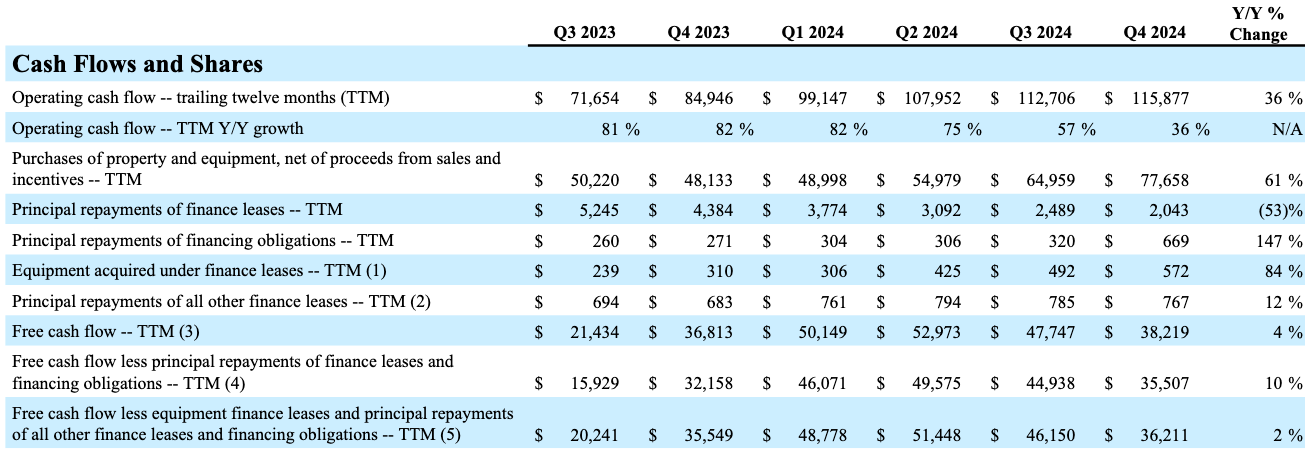

Amazon maintained financial discipline converting earnings to hard cash: Operating cash flow (OCF) reached $115.9 billion, a 36.6% increase YoY. This highlights Amazon’s ability to generate strong cash flows, which are critical given its aggressive reinvestment strategy in cloud infrastructure and AI.

Business Segments’ Performance

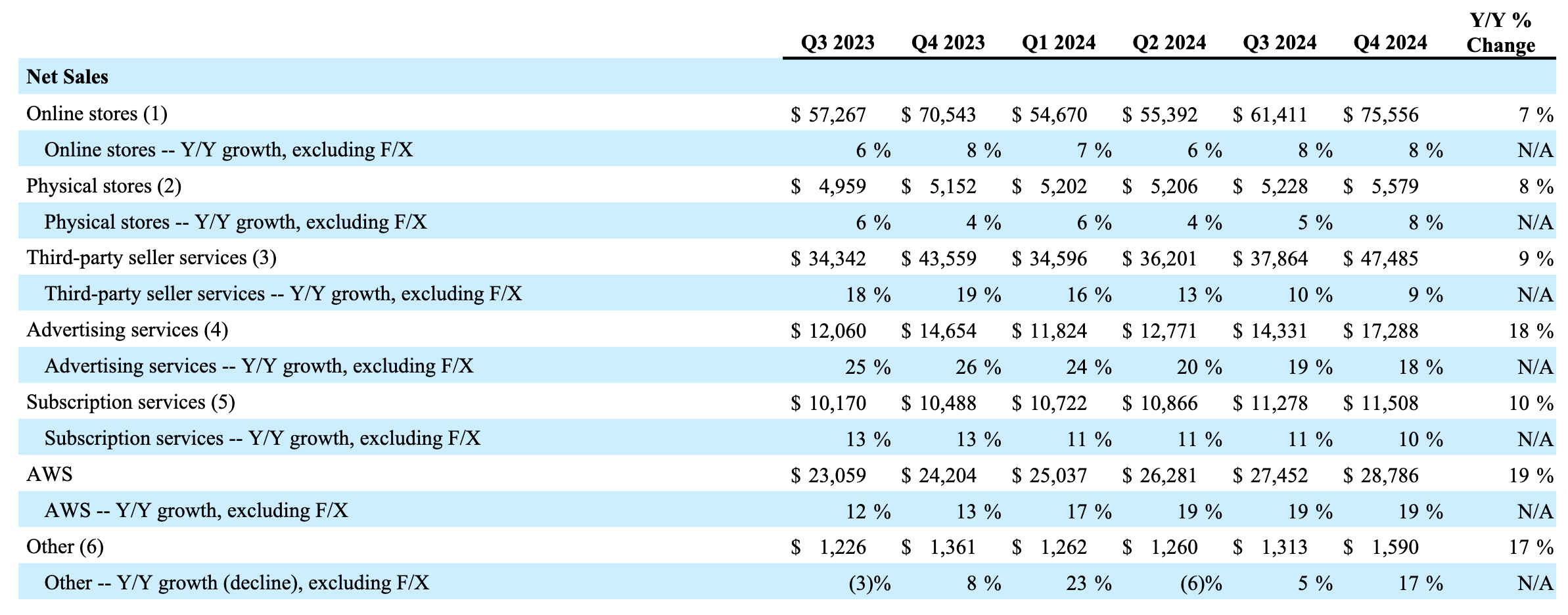

Amazon’s core e-commerce segment continues to grow steadily. Online stores expanded by 8% YoY, bolstered by significant efficiency improvements in Amazon’s fulfillment network. Jassy highlighted during the earnings call several drivers of profitability, including optimized inventory placement, enhanced packaging strategies, and the expansion of same-day delivery sites by over 60%, now covering 140 metropolitan areas and enabling over 9 billion same or next-day deliveries globally. These improvements reduced for the second consecutive year the per-unit global transportation costs while enhancing delivery speed and product selection. Amazon expects further savings as it scales automation with robotics in its logistics operations. This focus on efficiency has made e-commerce (first-party and third-party sales), a $123 billion business in Q4 2024 alone, a potential driver of profit growth, as even small margin improvements can significantly impact overall profitability.

However, Amazon has showed YoY growth deceleration in third-party seller services, advertising services, and subscription services.

Third-party seller services grew by 9% in Q4 2024, down from 19% in the same quarter of the prior year, reflecting slowing activity on Amazon’s marketplace.

Advertising services, though still growing robustly at 18%, marked a decline from 26% growth in Q4 2023, indicative of advertisers tightening budgets or shifting strategies. Jassy noted during the earnings call that “advertising business has more than doubled in size over the last four years”.

Similarly, subscription services, including Amazon Prime, saw growth slow to 10%, a slight drop from prior quarter’s performance. Jassy emphasized that Amazon’s full-funnel advertising approach, which includes targeting customers through Prime Video, homepage placements, and specialized product search ads, has made advertising more accessible and effective for businesses. This ensures that advertising remains a highly profitable and growing segment of Amazon’s business.

AWS and AI: The Key Growth Engines

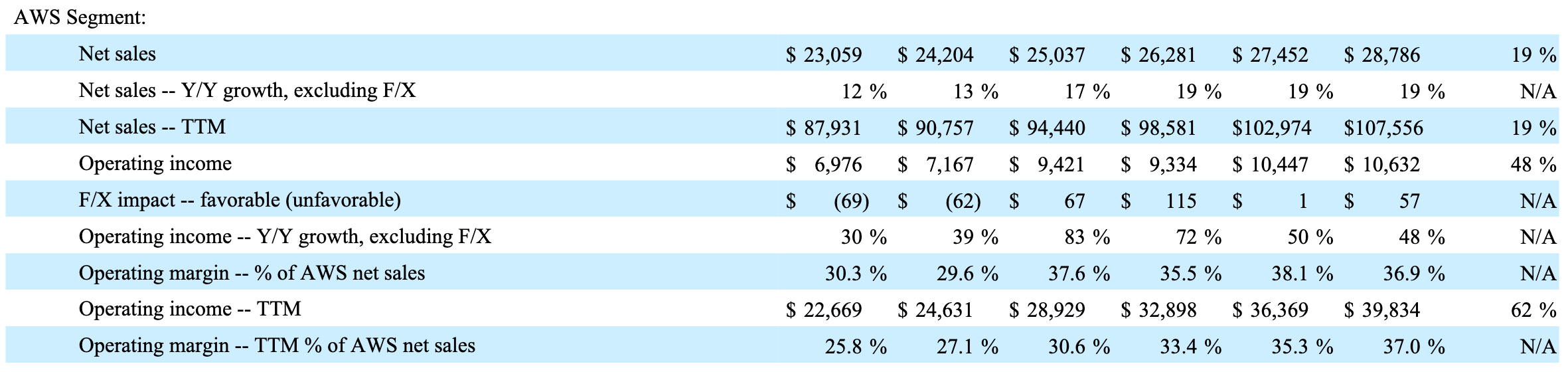

AWS continues to drive Amazon’s overall growth as a high-margin business. AWS revenue expanded by 19% YoY in Q4 2024 bringing in for the year $107.5 billion, maintaining strong momentum in the cloud computing space. Notably, AWS’s operating margins expanded significantly, rising to 36.9% in Q4 2024, compared to 29.6% in Q4 2023. Amazon was able to expand margins by growing revenue faster than its operating expenses. This is reassuring as this business segment continues to scale, its margins can expand further. On a going-forward basis, AWS is generating $115 billion in annualized revenue, which is impressive given its size. In Jassy’s words during the earnings call:

“AWS is a reasonably large business by most standards, and though we expect growth will be lumpy over the next few years as enterprise adoption cycles, capacity considerations, and technology advancements impact timing, it’s hard to overstate how optimistic we are about what lies ahead for AWS' customers and business.”

This highlights AWS’s centrality to Amazon’s profitability, as its margin expansion supports the company’s ability to reinvest heavily into future opportunities like AI and cloud infrastructure.

When compared to competitors, Google Cloud grew by 30%, Microsoft Cloud grew by 21%. Although AWS’s growth is considerably slower than Google Cloud’s, it remains the largest cloud provider, making its sustained double-digit growth particularly impressive.

Jassy, highlighted during the earnings call that AWS demand is currently resource-constrained due to a lack of capacity: supply chain constraints in chips, power, and server components have contributed to the reduced capacity to serve customers’ demand. This suggests that growth could have been even higher had Amazon been able to meet all customer requests.

Amazon views AI as a transformational opportunity akin to the advent of the Internet or cloud computing. In Jassy’s words:

“AI represents, for sure, the biggest opportunity since cloud and probably the biggest technology shift and opportunity in business since the Internet. And so, I think that both our business, our customers, and shareholders will be happy medium to long term that we’re pursuing the capital opportunity and the business opportunity in AI.”

The company is actively investing in data centers and AI infrastructure with over $100 billion of CapEx investments to alleviate these constraints in H2 2025 and beyond. Jassy is confident that this spending will generate a strong ROI:

“It’s the way that AWS business works and the way the cash cycle works is that the faster we grow, the more CapEx we end up spending because we have to procure data center and hardware and chips and networking gear ahead of when we’re able to monetize it. We don’t procure it unless we see significant signals of demand. And so, when AWS is expanding its CapEx, particularly in what we think is one of these once-in-a-lifetime type of business opportunities like AI represents, I think it’s actually quite a good sign, medium to long term, for the AWS business. […]

We’re still growing at a pretty reasonable clip, as I mentioned earlier, but I do think we could be growing faster if we were unconstrained. I predict those constraints really start to relax in the second half of ‘25. And as I said, I think we can be growing faster even though we’re growing at a pretty good clip today.”

Expanding Margins Show Operational Efficiency

One of the most important takeaways from Amazon’s earnings report is its margin expansion, which highlights improving operational efficiency across all geographies:

International e-commerce saw all-time high operating income, reaching $3.79 billion for the year, compared to an operating loss of $2.66 billion in 2023.

North America’s operating margin rose from 6.1% to 8% YoY, showing meaningful cost optimizations.

AWS’s operating margin expanded from 29.6% to 36.9%, reflecting continued efficiency improvements.

Even with revenue’s growth deceleration in some segments, Amazon’s ability to increase profitability demonstrates that its optimization efforts are working. The company is driving efficiencies in fulfillment, technology, and infrastructure, which is helping to balance out slower revenue growth.

Capital Allocation: Balancing Growth and Financial Discipline

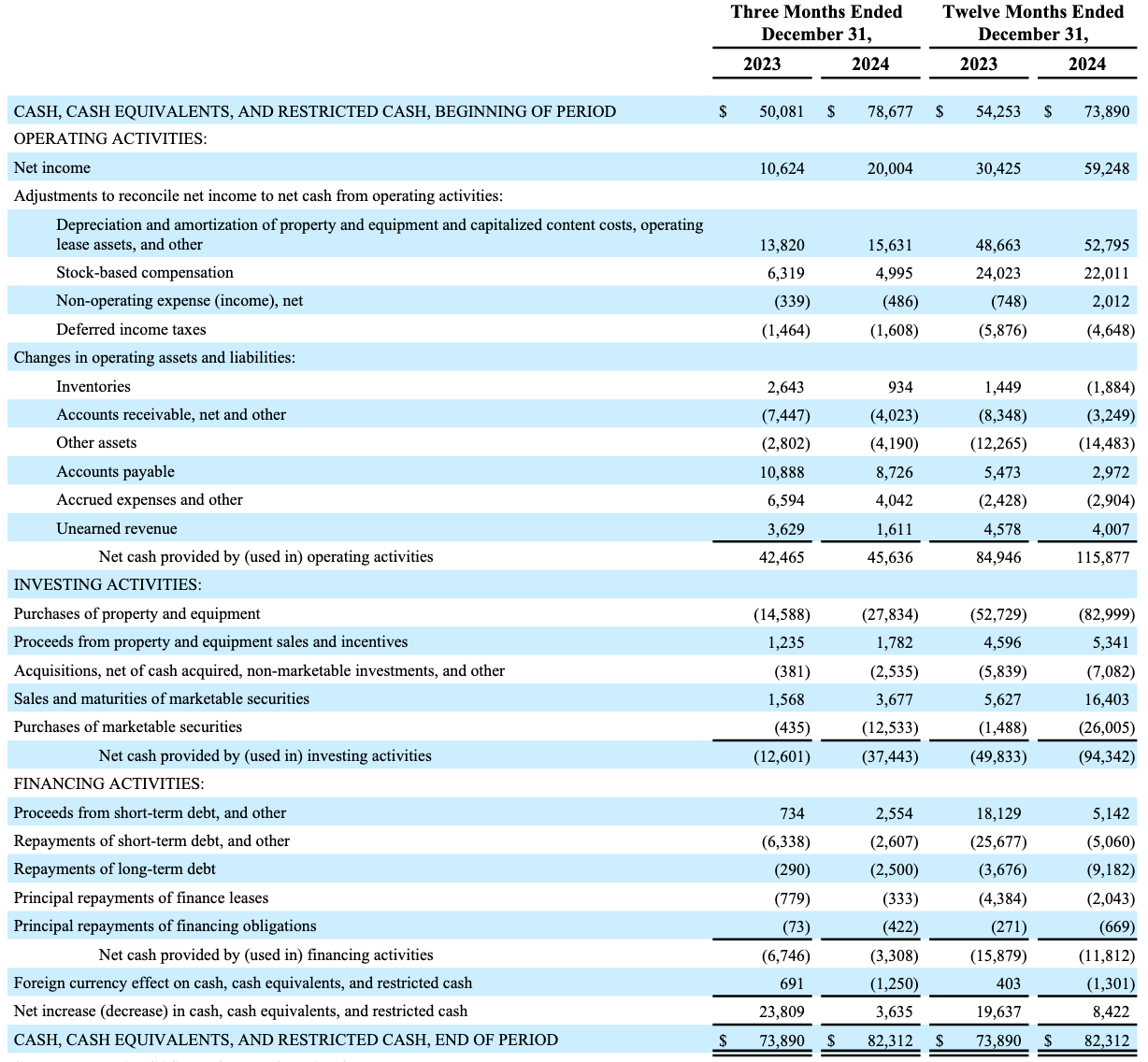

Amazon’s cash flow statement for 2024 highlights several important aspects of its capital allocation strategy, which underscores its focus on growth while maintaining financial discipline.

Reduction in Stock-Based Compensation (SBC): Amazon achieved a year-over-year decrease in stock-based compensation, dropping from $24 billion in 2023 to $22 billion in 2024. This reduction reflects a deliberate effort to manage employee-related costs more efficiently, aligning compensation with productivity and profitability.

Significant Capital Expenditures (CapEx) to support growth: Amazon invested $83 billion in capital expenditures (CapEx) in 2024, underscoring its commitment to expanding infrastructure, particularly in AWS and AI-related capabilities. Despite this massive outlay, the company remains resource-constrained to meet soaring demand for AI infrastructure. This highlights the urgency of scaling AWS operations to capitalize on the growing adoption of AI across industries. The planned $100 billion CapEx for 2025 further signals Amazon’s intention to reinforce its leadership in cloud and AI services.

Debt reduction strengthens balance sheet: Amazon allocated $14 billion to repay short-term and long-term debt during the year, showcasing prudent balance sheet management. Amazon was able to keep its current ratio (calculated by dividing the current assets by current liabilities) at 1.06x and increase substantially the shareholder equity (also known as book value, calculated by subtracting the total liabilities from the total assets) by 41.7% to $286 billion from $201.87 billion in 2023. This move reduces leverage and positions the company to better weather economic uncertainty, ensuring financial stability while it pursues aggressive growth investments.

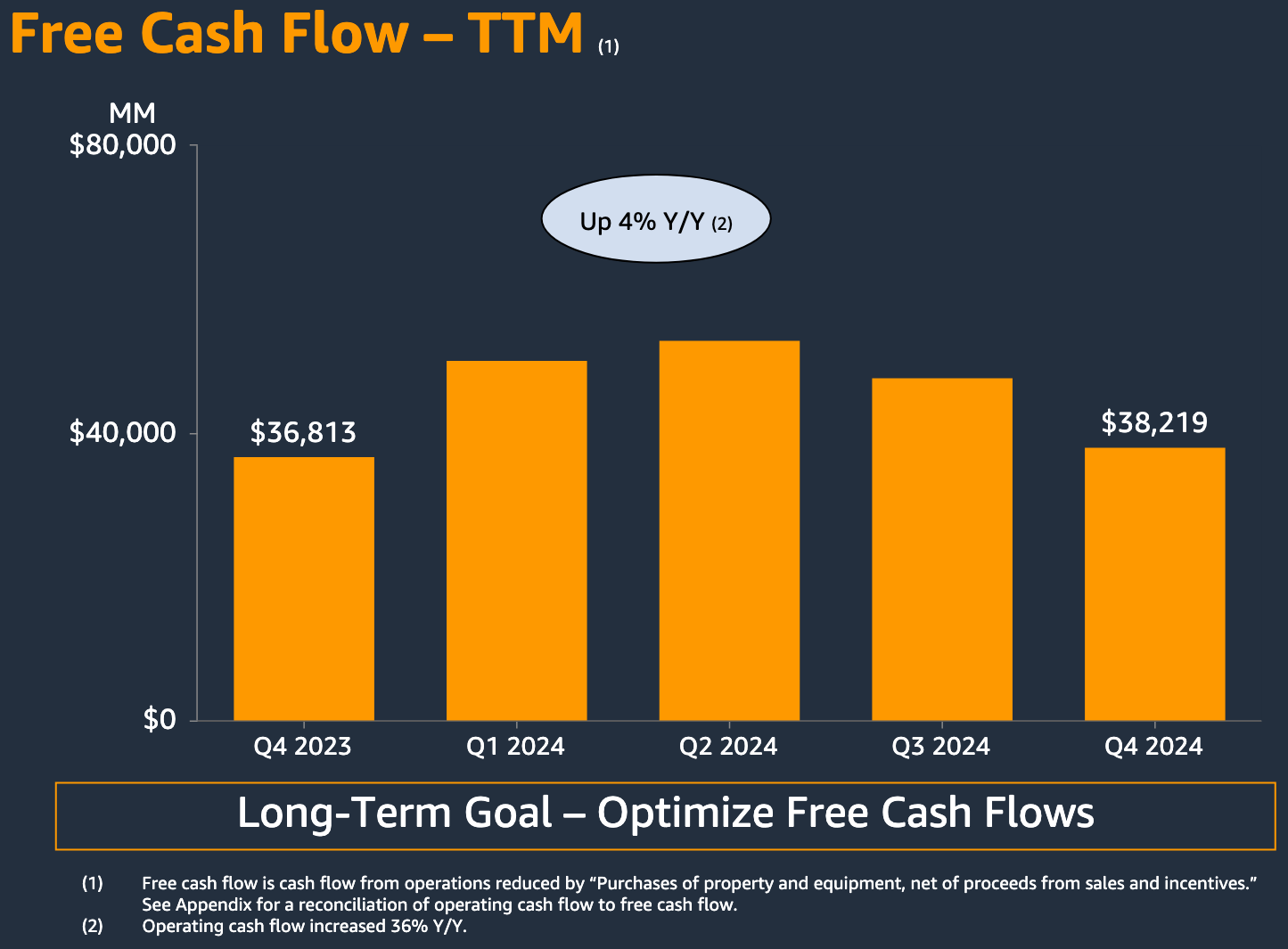

As a result of the high CapEx spending and debt repayments, free cash flow (FCF) saw only a modest year-over-year growth of 4%, reaching $38.2 billion in 2024. While this is relatively subdued, it reflects Amazon’s deliberate strategy to prioritize long-term growth over short-term cash generation.

Amazon’s capital allocation demonstrates a balanced approach, prioritizing long-term growth in high-margin segments like AWS and AI while maintaining financial discipline. Although FCF growth was modest, the investments made today are likely to yield substantial returns in the years ahead, reinforcing Amazon’s position as a market leader.

Why Did Amazon’s Stock Drop in After Hours?

Despite the robust numbers, Amazon’s stock declined post-earnings on Friday, February 7, 2025, largely due to the soft Q1 2025 guidance and concerns over escalating capital expenditures in 2025:

Q1 2025 revenue guidance: Between $151 billion and $155.5 billion, representing a 5-9% YoY growth, which signals an overall deceleration. Given Amazon’s sheer size, this is expected, but it nonetheless represents a slowdown compared to prior years.

Operating income guidance: Expected to be between $14 billion and $18 billion, compared to $15.3 billion in Q1 2024, indicating flat YoY growth in profits. This lack of projected earnings growth likely disappointed investors and contributed to the stock’s post-earnings dip.

Capital expenditures (CapEx): Amazon expects to spend over $100 billion in 2025, primarily on AWS infrastructure and AI capabilities. The market seems to remain cautious about whether this CapEx will yield strong returns, especially in a high-interest rate environment.

Valuation: Is Amazon Undervalued?

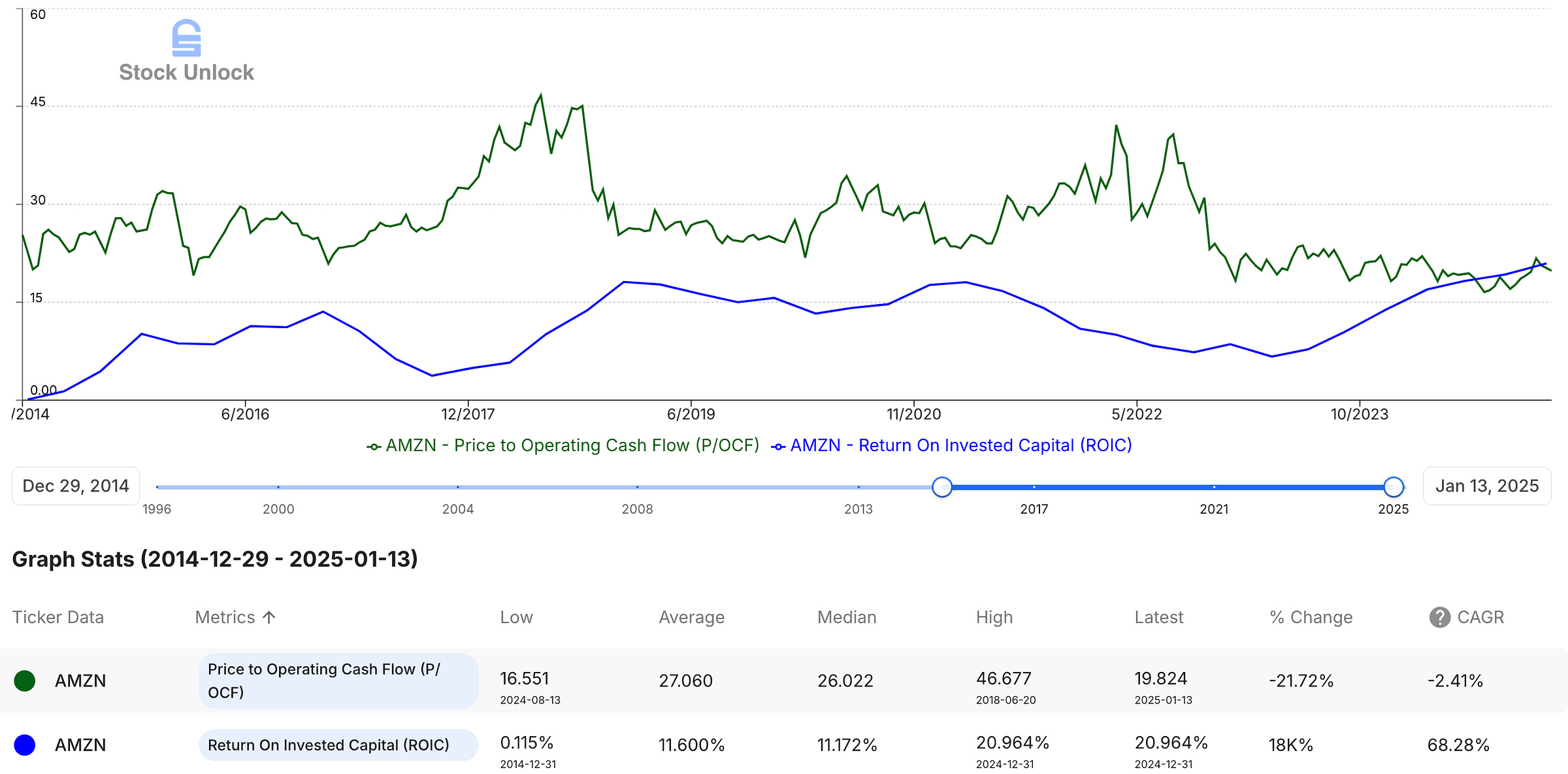

To value Amazon, I focus on operating cash flow (OCF) and return on invested capital (ROIC) as key metrics. Given Amazon’s consistent reinvestment of significant capital into its business through ongoing capital expenditures, I believe that free cash flow (FCF) does not accurately reflect the company’s future cash-generating potential.

Encouragingly, Amazon’s operating cash flow reached a record high in 2024, growing by 36.5% YoY, underscoring its ability to fund growth while maintaining strong cash generation. Excluding stock-based compensation (SBC), the company’s adjusted operating cash flow stood at $93.9 billion. In 2024, the company’s ROIC rose to 20.96%, up from 13.9% the prior year. With capital expenditure planned to be over $100 billion in 2025, even moderate returns on these investments could drive considerable profit growth from H2 2025. I intend to monitor the ROI on CapEx closely from Q3 2025 earnings.

I remain confident in Amazon’s direction, as management continues to demonstrate effective capital allocation. At the current market capitalization of $2.41 trillions, Amazon is trading at 19.8x operating cash flow, below its 10-year historical average of 27.1x, suggesting that it may be undervalued. Looking ahead, I believe operating cash flow and profitability have strong potential for growth well above the market average and over time this will ultimately be reflected in the stock price.

Despite short-term market concerns, my long-term investment thesis remains intact. Should negative sentiment persist, I will consider increasing my position, even though it is already my largest holding.

Final Thoughts

Amazon’s Q4 2024 and FYE 2024 results demonstrate why it remains the largest holding in my portfolio. While certain business segments, like third-party services and advertising, are experiencing growth deceleration, AWS continues to shine as a high-margin, high-growth driver. With a bold $100 billion CapEx plan for 2025, Amazon is positioning itself at the forefront of robotics innovation, AI and cloud computing, creating opportunities for sustainable, long-term growth.

Short-term market reaction to soft guidance and elevated CapEx is understandable and it ultimately presents opportunities for long-term investors. Margin expansion across AWS, North America, and international geographies showcases operational efficiency and highlights management’s ability to optimize profitability even in the face of elevated CapEx cycles.

The company’s commitment to reinvesting in high-growth areas, combined with disciplined financial management, reaffirms its potential to deliver substantial shareholder returns over the long term.

I remain bullish on Amazon’s future, confident that today’s investments will drive the company’s next phase of profitability and innovation. Should negative sentiment persist, I am prepared to increase my position, further solidifying Amazon as a core holding in my portfolio.