Why "Top Stocks for Next Year" Lists Are Misleading And What Actually Builds Wealth

Building lasting wealth by patiently investing in businesses, not headlines

Every year-end, flashy headlines like Best Stocks to Buy for 2025 or Stocks Set to Skyrocket Next Year flood financial news and blogs.

Let’s be honest, these top stock picks lists are rarely useful and often misleading.

The Clickbait Trap

This isn’t a personal jab at the people writing these articles. Even major financial publications and popular investing blogs churn them out because they know one thing, they work.

Headlines promising quick riches drive clicks, likes, and shares. Most people want gains today or next year, not through steady compounding over decades. Market commentators and content creators capitalize on this short-term mindset.

These lists are often based on hype, trends, or guesses rather than rigorous research and fundamental analysis. They’re designed to grab attention, not to build wealth.

Short-Term Thinking Is Dangerous

Investing isn’t about timing the next 12 months; it’s about identifying businesses poised for predictable, long-term value creation.

“If you aren’t willing to own a stock for ten years, don’t even think about owning it for ten minutes.”

— Warren Buffett

The premise behind these top stock picks is fundamentally flawed: They focus on stocks expected to appreciate in share price over the next year. But gains driven by multiple expansion don’t just make them riskier bets, they also compress future returns.

“Risk is not inherent in an investment; it is always relative to the price paid.”

— Seth Klarman

For level-headed investors, this is a losing tradeoff. What looks like a quick win today often comes at the expense of sustainable, compounding growth in the years ahead.

And then what? If you buy a stock recommended by someone else for the next 12 months and it skyrockets due to momentum or hype, you’re left facing another dilemma when the year ends, do you sell and chase another stock recommendation, or do you hold? If you choose to hold, are you prepared to weather a downturn if enthusiasm fades and the price declines? Or would you be tempted to sell out of fear, locking in short-term gains but possibly missing out on long-term compounding?

Worse, these recommendations aren’t personalized to your risk tolerance, time horizon, or investment goals, making them even less useful.

The Problem with Predictions

Financial analysts often miss the mark when forecasting stock performance. Studies show that their 12-months price targets often deviate significantly from the actual prices a year later1.

Analysts’ predictions can’t account for sudden market shifts, unexpected earnings reports, or economic surprises - factors that directly influence investor sentiment and short-term stock price movements.

Interestingly, analysts tend to be more accurate when forecasting fundamentals, such as revenue and earnings growth, over the next few quarters, especially for well-established businesses. Studying a company’s track record, competitive position, and industry trends allows for reasonable estimates of near-term fundamentals.

However, stock prices often diverge from business fundamentals in the short term: This mismatch stems from market sentiment, valuation fluctuations, and macro factors that distort price movements.

Simply put, even when we get the fundamentals right, predicting how the market will price those fundamentals in the next 12 months remains highly unreliable.

What Really Builds Wealth

Instead of chasing speculative bets, I focus on businesses led with integrity, featuring durable moats and positioned for sustainable growth. These are the kinds of businesses that don’t just shine for a year, they deliver value for decades. Over the long run, stock prices follow fundamental performance, reflecting the true value created by these companies. As Benjamin Graham famously said:

“In the short term, the market is a voting machine; in the long term, it’s a weighing machine.”

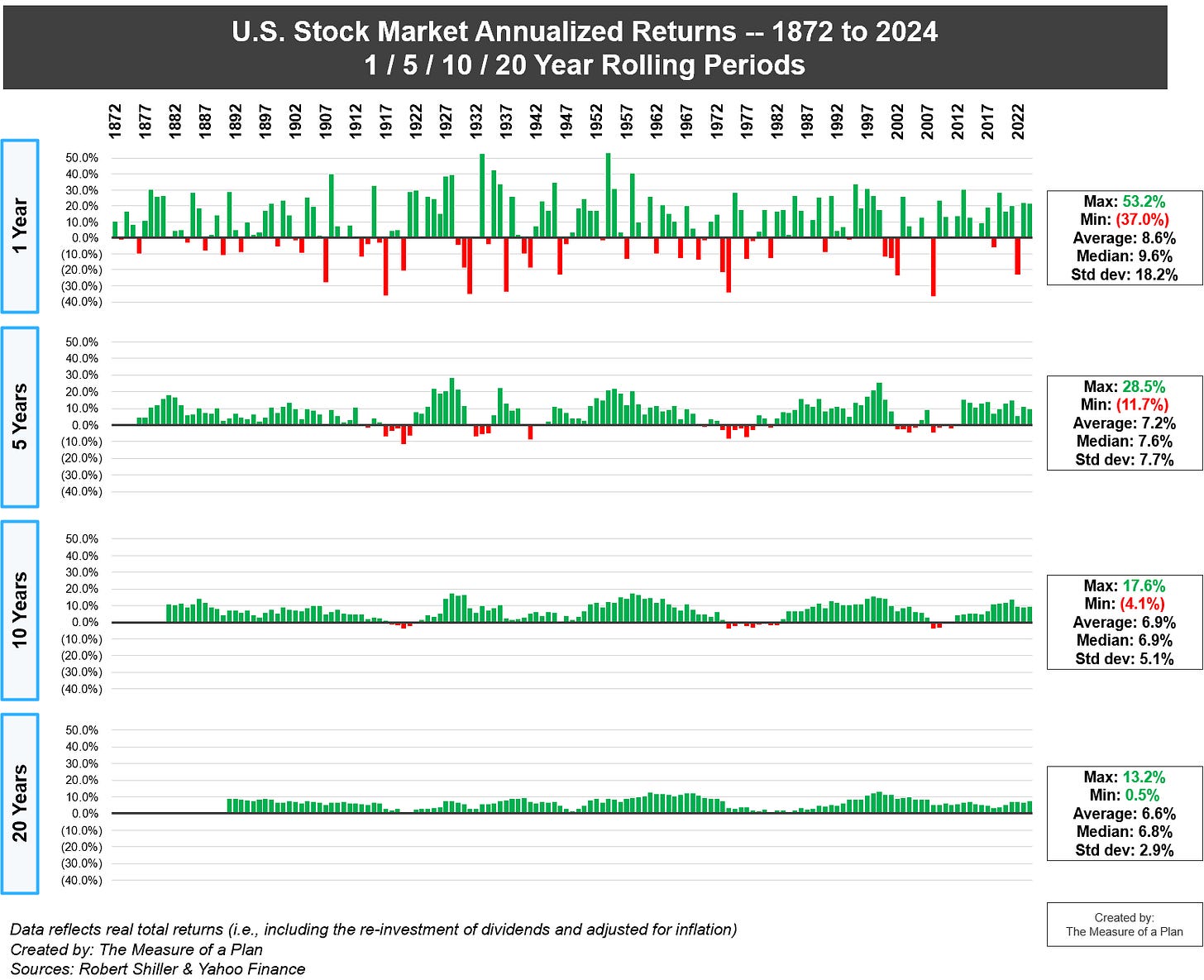

The odds of success increase dramatically the longer I invest. For example, historical U.S. stock market returns shows that while one-year outcomes can be unpredictable, rolling 10 or 20-year periods have been overwhelmingly positive, even through recessions and bear markets.

Investing with a long-term mindset isn’t flashy, but it works.

Final Thoughts

Reading top stock picks articles is tempting. They’re easy to digest and feel actionable. However, meaningful investing isn’t about chasing headlines.

Instead, I focus on building and maintaining a concentrated portfolio of high-quality businesses with durable competitive advantages and sustainable growth potential.

The same principle applies to my approach to writing on Level-Headed Investing: I’ve made a conscious decision to prioritize quality over quantity in my content. If that means having fewer clicks, likes, or shares, so be it.

I take every reader’s time seriously and aim to write only about what I firmly believe in, not what’s trending or guaranteed to attract attention. I believe that investing is about substance, not sensationalism, and I strive to reflect that philosophy in every article I publish.

Thank you for reading, and here’s to level-headed investing and lasting wealth creation.

A study titled Do Sell-Side Analysts Exhibit Differential Target Price Forecasting Ability? found that, on average, only 38% of target prices are met by the end of the 12-month forecast horizon, underscoring the challenges analysts face in accurately predicting stock prices.